The new entry point: Why Atlassian Acquired The Browser Company

Atlassian’s acquisition of The Browser Company (maker of Dia and Arc) raised a lot of questions. Here are five reasons why this may have been a great strategic move.

Reforge’s Fall Cohort of AI courses starts October 14th, including guests from OpenAI, Canva, GitLab, Descript, Laurel and many more. Enroll now to secure a spot.

AI Growth | AI Leadership | AI Strategy | AI Foundations | AI Productivity | All Courses

Atlassian recently made headlines when it acquired The Browser Company for $610 million in cash. The Browser Company makes Arc and Dia, with the latter being the focus of this deal.

The M&A market is both active and frothy right now as companies jostle for positioning in a quickly changing market. Atlassian has a rich history of M&A, but this one hit different.

The world was different back in 2023 when Atlassian acquired Loom for $975 million. We broke that acquisition down on an episode of Unsolicited Feedback. That was largely viewed as a pragmatic move. Loom fit nicely into Atlassian’s suite of asynchronous collaboration tools and created a new entry point for users. The same goes for the 2017 acquisition of Trello. These tools gained escape velocity thanks to the consumer-grade experience, strong growth loops and freemium price point.

But even back in 2023, Atlassian’s flagship products Jira and Confluence were starting to gather some “enterprise dust.” Each was and is good software and a profitable line of business, but as the company moved upmarket, it couldn’t rely exclusively on product-led growth (PLG) anymore. In 2020, enterprise sales accounted for 15% of sales. By Q1 2025, it’s >40%.

As so often happens, this changed the sentiment around the products too. Over the last few years, Jira and Confluence’s relevance has faded among small teams and startups who gravitated en masse towards Linear and Notion.

You can see the Innovator’s Dilemma from a mile away. The company that was a pioneer of the product-led growth model was starting to lose a sliver of market share to upstart competitors. But if a new generation of startups prefer Linear and Notion, what happens when those companies grow up?

It’s relatively easy to work backwards to the strategic reasoning behind the Loom acquisition. Atlassian wanted a product with viral growth potential that also passes the “toothbrush test,” meaning there’s a reason to use it every day. And the deal has proven to be a good one. In its August 2025 earnings, Atlassian reported that Loom’s monthly active users are growing more than 30% year-over-year.

Here are five smart reasons why Atlassian may have acquired The Browser Company

The Browser Company deal isn’t as straightforward. Browsers are among a small handful of the most important tools people use on a daily basis, but have mostly been dominated by the tech’s biggest players, namely Google and Apple. Where Loom fit nicely into Atlassian’s existing suite, The Browser Company acquisition is a much bolder bet on a future that looks very different than today.

Tech Twitter had a field day with this news. It was highly entertaining, but mostly poked fun at the deal. Atlassian is a legendary SaaS company, so I analyzed this deal under the assumption that the people making it are smart, thoughtful, and deliberate. Knowing plenty of people who work or have worked at Atlassian (including many Reforge alums), I know this to be true.

Here are the five reasons this deal may make sense.

1: Agents are an existential threat to Atlassian’s core business model

Atlassian built its strategy around a simple playbook. JIRA becomes the starting point for development teams, then it can cross-sell Confluence, Bitbucket, Trello, and other tools. This worked because JIRA owned the daily workflow for millions of developers and project managers.

That foundation is shifting. New AI-powered starting points are building daily habits with users. ChatGPT has become the first stop for many knowledge workers. Claude handles complex analysis. Cursor is becoming the go-to environment for AI-assisted coding.

These aren't just new features—they're becoming the new entry points for how people work. When you start your day asking ChatGPT to help plan your sprint or use Cursor to write code, you're bypassing traditional SaaS applications entirely.

The math is simple for Atlassian. If agents become the primary interface for work and those agents are controlled by OpenAI, Anthropic, or other AI companies, then owning JIRA matters less. You can't cross-sell adjacent products if users never visit your core product.

ChatGPT, Claude, and Cursor have already claimed significant mindshare as AI starting points. Rather than compete directly in that space with little chance of winning, it placed a bet on browsers as an alternative entry point that might still be winnable and have room for innovation.

2: B2B browsers create a new aggregation layer for enterprise work

The hypothesis is that AI will create separate B2B and B2C browser markets, and this positioning could be extremely valuable.

First, enterprise data and context requirements are fundamentally different. AI applications need massive amounts of data and context to produce valuable outputs. Do companies want that sensitive business data stored in browsers employees also use for personal browsing? Enterprises need control over where this information lives and how it flows between applications.

Second, user behavior has already shifted. Most people don’t interact with personal applications through desktop browsers anymore because that’s moved to mobile. Your desktop browser usage is primarily work-focused now, but Chrome and Safari were built for general consumer web browsing, not enterprise workflows.

But there's a bigger opportunity here. The browser sits at a unique position in the technology stack: one layer above individual applications like ChatGPT or Slack, but one layer below your operating system. This gives it potential to coordinate across everything you do at work.

Think about how Apple leveraged this positioning on mobile. By controlling the device layer, it can coordinate experiences across apps in ways individual app makers cannot. A B2B browser could play a similar coordinating role for knowledge work.

Imagine a new employee joining your company. Instead of logging into fifteen different applications and manually providing context to various AI agents, they spin up a pre-configured browser with access to approved applications, relevant data, and connected identity systems.

This represents the shift from "systems of record" to "systems of action." The places where you take action become more valuable than where you store information. Atlassian already serves enterprise customers, understands compliance needs, and has established IT relationships, which are advantages that consumer browser makers can't easily replicate.

3: Atlassian needs bigger bets to keep growing

Atlassian has reached the scale where incremental moves won't generate the growth it needs. Its main strategy for years has been adding adjacencies to the JIRA suite—Confluence for documentation, Trello for project management, Loom for video communication, etc.

This adjacency playbook works up until a point, similar to how HubSpot added marketing automation, CRM, and service tools around its core marketing product. But there's a limit to how many adjacent tools you can sell to the same customer base.

At its current scale, it needs whole new S-curves for growth. Companies exist to grow, and if they're not growing, they immediately shift into harvest mode. Atlassian may be entering its moonshot phase, similar to Google's "Other Bets" division.

The browser market represents massive potential upside. If you own one of the primary starting points for how people work, it’s an enormous business opportunity. Even if it’s a low probability bet, the potential return justifies the investment for a company with $3 billion in cash and strong free cash flow.

This isn't unusual for companies at Atlassian's stage. It’s moved beyond optimizing its existing products and into territory where it needs to find entirely new areas of business.

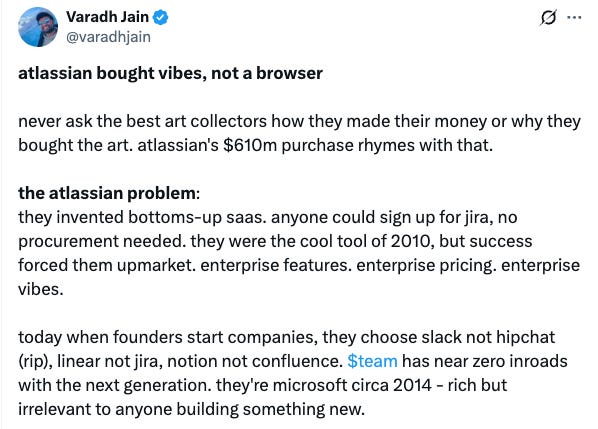

4: The "Atlassian Problem" - losing the next generation

We follow this exact pattern at Reforge. Our stack includes Linear for project management, Notion for documentation, and Slack for communication. The one Atlassian product we use is Loom, which it acquired specifically to address this problem.

This is a common lifecycle for SaaS companies. You start by serving early adopters and small companies without switching costs. Success drives you upmarket where the money is, but that opens the door for new competitors to capture the bottom of the market.

If new companies prefer different tools, what happens when those companies grow up? Atlassian risks becoming "rich but irrelevant to anyone building something new" but its leadership is aware enough to fight it.

The Browser Company acquisition follows the same logic as Loom. Get an entry point with next-generation companies in an adjacent space where you can potentially bridge back to your core products over time.

5: It’s not as expensive as it seems

The numbers put this deal in perspective. Atlassian has $2.9 billion in cash, so $610 million represents about 20% of its current cash position. It also generates about $1.4 billion in free cash flow per year. For a company with strong free cash flow and profitable operations, this is manageable risk for potentially massive upside.

$610 million sounds crazy on the surface because it's a lot of money, but it's actually a relatively small bet for a company of Atlassian's scale and financial strength. It’s always been contrarian: profitable at IPO, based in Australia, very low-priced, and had no sales team for years.

If browsers become a new starting point for work and Atlassian captures even a fraction of that market, the return would be enormous. Even if it's a low probability outcome, the potential upside justifies the investment. This is exactly the type of calculated risk a company at its stage should be taking.

Why the acqui-hire theory doesn't hold up

I've seen some people suggesting this was an expensive talent acquisition deal, similar to what we've seen with other AI-focused acquisitions. The facts don't support this theory.

First, the deal structure is wrong. Talent acquisitions typically use stock, not cash, to retain key employees through equity. Atlassian paid $610 million in cash, which suggests it’s serious about the product strategy rather than just acquiring a team.

Second, its public statements contradict this theory. Atlassian and The Browser Company founders have been explicit about their intention to "reinvent the browser for knowledge work." It’s hiring 50 more people and making clear investments in the product direction.

Finally, Atlassian doesn't have the talent attraction problems that would justify this approach. Unlike older enterprise companies that struggle to recruit top engineering talent, Atlassian remains an attractive employer that can compete for talent through traditional hiring rather than expensive acquisitions.

The talent at The Browser Company is impressive, but not irreplaceable at this price point. This deal is about product strategy and market positioning, not just acquiring a team.

It’s everyone vs. everyone

As we discussed on Unsolicited Feedback, it’s Everyone vs Everyone right now. The M&A market reflects how seriously companies are taking the AI transition. The frothy valuations and bold acquisitions we're seeing aren't just about current capabilities. These are about positioning for a fundamentally different future.

The mobile and cloud shifts created space for new players to build without stepping on each other's toes. AI collapses those boundaries. Companies that never competed before are suddenly fighting for the same customers as AI expands what each business can offer.

This is exactly what’s happening with Atlassian. I doubt it ever considered Google a direct competitor in the past, but it’ll go head to head in the browser wars.

Pretty good take. Seems like OpenAI and Microsoft could both be developing agentic browsers though. Many laptops come with an AI mode, with a specific keyboard key dedicated to Copilot.

Where would Atlassian land then?

I use a Mac and a Windows laptop, both. Like having both to test out things.

Arc is helpful on the Mac but not as much on Windows since Microsoft has already built out those features (and some more). Loom is helpful on Mac, but not as much on Windows for the same reason. So, I get it if Atlassian could compete with Safari since Apple's unlikely to enter into the space. But Microsoft will compete.

Thanks for featuring my post!

https://afewthoughts.substack.com/p/atlassian-bought-vibes-not-a-browser