The Next Great Distribution Shift

Facebook, Google, Apple, LinkedIn—every platform followed the same brutal pattern: open, grow, close, monetize. The next distribution monopoly is coming, and most leaders aren't prepared.

Thank you to Casey Winters, Aaron White, Dan Hockenmaier, Fareed Mosavat and Adam Fishman for reading early versions of this and providing feedback. They are all smarter than me so you should go follow them.

Note: Since publishing this post, my prediction has started to play out. ChatGPT launched the early version of their App SDK and is planning on a bigger launch sometime in late 2025/early 2026. To know what to do next, I suggest reading this post: How To Navigate The AI Distribution Shift.

The Missing Piece of the AI Revolution

Here's something that should keep every product leader up at night: We're living through one of the most significant technology shifts in history, yet we're still distributing products like it's 2015.

The AI revolution has transformed how we build products. We can now create experiences that would have been impossible just two years ago. But there's a glaring problem—this technology shift has come without a distribution shift. In fact, AI is actively destroying the distribution channels we've relied on for decades. SEO traffic is plummeting as users shift to answer engine platforms. Social algorithms are more unpredictable than ever. The old playbooks are burning.

But I believe we're on the precipice of something bigger. The next great distribution shift is coming, and it's going to reshape how products find users just as dramatically as search engines and app stores did before it.

When this shift happens—and the early signals suggest it's already beginning—there will be extraordinary windows of opportunity. There will also be casualties.

Every major new platform follows the same playbook: They start open and generous, practically begging developers to build on their platform. They need you to help solidify their moat. But once that moat has escape velocity? The walls go up. The taxes increase. The rules change. What was once free becomes paid. What was once permitted becomes forbidden.

Some platforms are surgical about it—Google took years to tighten its grip. Others are brutal—Facebook famously left "a trail of dead apps and battered businesses" when it shut down viral channels overnight. But they all follow the pattern.

The difference between the companies that thrive and those that get crushed? They understand the game being played. They see the pattern. They prepare for the inevitable shift from open to closed.

I first discussed the above concept with Fareed Mosavat and Aaron White on Unsolicited Feedback. Here is the full episode: YouTube :: Apple :: Spotify

In this post, I go much deeper:

I'm going to show you exactly how this cycle works.

We'll walk through the rise and fall of multiple major distribution platforms from Facebook to Google to LinkedIn.

I’ll predict who I think will be the next distribution platform and why.

Most importantly, we'll cover what you need to do now—before the window closes—to position your product for success in the AI platform era.

Because here's the truth: You can't opt out of this game. Your competitors won't. Your users won't. The only choice is whether you play it with your eyes open or closed.

Let's make sure you see what's coming.

Technology Shifts vs Distribution Shifts

In December 2023, Casey Winters published an important essay that I’ve been thinking about since. In "On Platform Shifts and AI," he made a distinction that every product leader needs to understand.

What separates a major platform shift from a minor one isn't the technology itself. It's whether that shift enables both new ways of building things AND new ways of reaching people.

These dual shifts—technology plus distribution—are what create the conditions for new multi-billion dollar companies to emerge. But here's where Winters' insight gets really interesting, and where most people miss the pattern:

"What I realized having gone through the internet and mobile platform shifts is that the technological and distribution shifts did not happen at the same time. Platform shifts that create both technological and distribution opportunities happen in a sequence, not all at once."

This sequence is everything.

As Casey Winters said:

The internet created websites in the early 1990s, but Google didn't emerge as the dominant distribution mechanism until 1998—and didn't truly monetize until the 2000s. That's nearly a decade between the technology and the distribution.

Mobile apps launched with the iPhone in 2008. Everyone rushed to build apps, convinced the App Store would be the distribution revolution. Remember "there's an app for that"? But most of those early apps died. The real distribution shift came four years later when Facebook launched mobile ads in 2012. Suddenly, apps could find users at scale, and companies like King (Candy Crush) and Supercell (Clash of Clans) exploded from nothing to billions.

Which brings us to AI.

We're clearly in the middle of a massive technological shift. AI has enabled entirely new ways of building products—from conversational interfaces to autonomous agents to personalized experiences that adapt in real-time. The technology is here, and it's spectacular.

But where's the distribution?

Yes, we’ve had break out companies like Cursor that have reached immense scale and broken growth records. But this has been off the back of word of mouth driven by the technology, not a new sustainable distribution channel.

ChatGPT has 700 million users, yet it's not a distribution channel, it's a destination. If anything, AI is destroying distribution channels. SEO is collapsing as answer engines like Perplexity, ChatGPT Search, and others keep users in its experience rather than sending traffic out. Social platforms are becoming walled gardens, limiting traffic being sent elsewhere. X has banned links, LinkedIn punishes posts that link externally, and the list goes on. The old channels are dying, but the new ones haven't emerged.

As Casey Winters put it in his December 2023 essay:

"ChatGPT is 'not it,' as the kids would say. At least not yet."

But, and this is crucial, we shouldn't expect the distribution shift to have happened yet. If history is our guide, we're right on schedule. The AI technology shift started gaining mainstream adoption in late 2022 with ChatGPT. If it follows the mobile timeline, we wouldn't expect to see the distribution shift until about 2026 or 2027.

Except I think it's going to happen faster this time. The platforms have learned from history. They know the playbook. And the early signals suggest they're already moving.

The question isn't whether a new distribution channel will emerge. It's who will control it, how open it will be, and whether you'll be ready when it arrives.

The Repeating Cycle: From Open To Closed

I believe we're at an inflection point. The distribution shift that's been missing from the AI revolution is about to arrive.

But before I explain who I think it is going to be and why, you need to understand the playbook. Because every major distribution platform in history has followed the same three-step cycle. Once you see it, you can't unsee it.

The Three-Step Cycle

Step 1: Identify the Moat

Every platform starts by figuring out what will make them unassailable. For Facebook, it was the social graph—who knows whom. For Google, it was search data—what people want. For Apple, it was having an application ecosystem to attract premium device owners. The moat determines everything that follows.

Step 2: Open the Gates

Once they know what they need, platforms become generous. They create "open" ecosystems, practically begging developers to build on top of them. Free API access. Viral growth mechanics. Revenue sharing that seems too good to be true.

Why? Because they need you. Your apps, your content, your data, your innovations—they all feed the moat. Every developer or creator who builds on the platform makes it stronger and harder to displace.

Step 3: Close for Monetization

This is where the pain happens. Once the platform achieves escape velocity, once the moat is so strong that users have no choice but to stay, the rules change. What was free becomes paid. What was permitted becomes restricted. The platform starts competing with its own developers, sometimes killing the very businesses that helped it grow. Sometimes this is deliberate and planned, sometimes this is a result of an emergent business need. But the ending is always the same. They do this systemically in three ways:

Build first-party versions of the most popular third-party applications.

Tax directly by taking a percentage of revenue.

Tax indirectly by artificially reducing organic reach to push towards their paid advertising.

Critical Warnings About This Cycle

The timeline is unpredictable but accelerating. Facebook went from open to closed in about two years. Apple took four. Google stretched it over two decades. You can't set your watch by it, but you can watch for the signals. I believe in AI, the players will be more ruthless because the stakes are much larger.

Step 3 is a bloodbath. When platforms close, there are casualties. Facebook's 2010 policy changes caused Zynga's player count to plummet overnight. Apple's in-app purchase requirements destroyed entire business models. Most developers are completely unprepared for how aggressive the platform will become.

Knowledge is survival. The companies that thrive through platform shifts aren't necessarily the biggest or best-funded. They're the ones who understand the game being played. They build with the end in mind. They extract value during Step 2 while preparing for Step 3.

The platform isn't your friend. It's not your enemy either. It's a force of nature. You can surf the wave or get crushed by it, but you can't stop it from coming.

Let's look at exactly how this cycle has played out across major distribution channels. The patterns are so consistent it's almost eerie.

Facebook Developer Platform

In May 2007, Facebook wasn't the inevitable winner we know today. They had 25 million users—impressive, but hardly dominant.

The competitive landscape was brutal:

MySpace: 107 million users (over 4x Facebook's size)

hi5: 70 million users

Friendster: 50 million users

Orkut: 30 million users

Plus regional champions like Bebo (UK), StudiVZ (Germany), Vkontakte (Russia) and Tuenti (Spain)

Facebook was just one player in a crowded field, and there was no guarantee they'd win. They needed something to hit escape velocity before another platform locked in the global social graph.

Step 1: Identifying the Moat

Facebook recognized their moat was the social graph itself—the network of who knows whom. It's a classic direct network effect: the platform becomes exponentially more valuable as more of your friends join. But they had a problem. Building that graph user by user, friend by friend, was too slow. They needed acceleration.

Step 2: Opening the Gates

In May 2007, Facebook launched f8 and their developer platform. Mark Zuckerberg's opening line at the announcement is hilarious in hindsight:

"Until now, social networks have been closed platforms. Today, we're going to end that."

The irony of that statement would only become clear years later. Facebook's initial offer to developers was remarkably generous:

We’ll provide you a canvas to build anything you want on our platform

Use our viral channels to grow as fast as you can

Keep 100% of your app's revenue

We'll just monetize the sidebar ads

The response was explosive. By late 2007, over 7,000 apps existed on the platform, with 100 new apps launching every single day. By mid-2008, there were 33,000 apps and 400,000 registered developers. Users couldn't install apps fast enough—games, quizzes, vampire bites, zombie attacks, you name it.

The strategy worked perfectly. Each app helped bring in new users, drive engagement, and expand the graph. Facebook grew from 25 million to 250 million users in just two years, leaving MySpace and the others in the dust.

Step 3: Closing for Control

Once Facebook achieved escape velocity, the generosity ended. The closing happened in waves, each more restrictive than the last.

2009-2010: The Viral Channels Disappear

Notification limits introduced

App-to-user communication restricted

News feed algorithm changes reduce app visibility

Invite systems throttled

Zynga, the social gaming giant behind FarmVille, reported that after the 2010 policy changes, "the number of our players on Facebook declined." This was a company valued at $10 billion, brought to its knees by a few API changes.

2010-2011: The Tax Man Comes

Facebook Credits becomes mandatory for all apps

Facebook takes 30% of all transactions

Direct payment methods banned

Alternative monetization restricted

2011-2012: The Feature Absorption

Facebook launches native alternatives to popular apps like Photos, Events, Groups, Location, Marketplace, and more.

Platform features that apps relied on get deprecated

Custom page tabs removed (BandPage lost 90% of its traffic overnight, dropping from 35 million to 3 million users)

By 2012, what Zuckerberg had proclaimed as an "open platform" had become one of the most tightly controlled ecosystems in tech. Facebook's platform left behind a trail of dead apps and battered businesses.

The most telling detail? Facebook insiders jokingly called their developer relations effort "Operation Developer Love"—acknowledging that it was more about extraction than partnership. Brutal.

It wasn’t just apps as well as Casey Winters notes:

Facebook pages worked the same way. They incentivized companies to grow page likes to get free distribution. Then distribution turned paid even if a user liked your page.

The Lesson

Facebook's platform shift established the modern template:

Use developers to build what you can't build alone

Let them take the risks and validate use cases

Once you've won, take back control and monetize aggressively

Every platform has run this same play. The only variables are timing and temperament. Some platforms are patient predators, waiting years before tightening the noose. Others move fast and break things—including their developers' businesses. Some are doing it on purpose. Some are doing it as a reaction to a business need. It does not matter. It always ends the same. Let’s take a look at a few more examples.

Apple App Store

Just as Facebook faced fierce competition in social networking, Apple entered the smartphone market as an underdog. In 2008, when the App Store launched, the mobile landscape looked nothing like today's iOS-Android duopoly:

Nokia: 40% global market share with Symbian OS

BlackBerry: The enterprise standard, growing rapidly

Windows Mobile: Microsoft's strong presence

Android: Just launching, but backed by Google

The iPhone was revolutionary but expensive, limited to AT&T, and lacked basic features like copy-paste. Apple needed something to make the iPhone indispensable—to justify the premium price and lock in users before Android gained momentum.

Step 1: Identifying the Moat

Apple recognized their moat wasn't just hardware—it was the ecosystem. If they could make the iPhone the platform with the best apps, apps you couldn't get anywhere else, they'd create switching costs so high that users would never leave. The network effect was more apps led to more iPhone users which led to more apps. But Apple couldn't build all those apps themselves.

Step 2: Opening the Gates

In July 2008, Apple launched the App Store with what seemed like a developer-friendly proposition at the time:

70/30 revenue split (developers keep 70%)

Free app hosting and distribution

Seamless payment processing

Access to millions of credit cards on file

Global reach from day one

Steve Jobs pitched it as revolutionary: "This is the best deal going to distribute applications to millions of users."

The results were staggering. "There's an app for that" became a cultural phenomenon. By 2010, the App Store had 225,000 apps and had generated $2.5 billion in revenue. Developers were making real money—some becoming millionaires overnight with simple apps like iFart and Beer Pong.

The App Store became the iPhone's killer feature. While Android was free, iOS had the apps people wanted. The moat was established.

Step 3: Closing for Control

Unlike Facebook's relatively quick closure, Apple played a longer game. The restrictions came slowly, each justified by "user experience" or "security," but the pattern was unmistakable:

2011: The In-App Purchase Mandate

All digital content must use Apple's payment system

No links to external payment methods allowed

30% commission on all digital goods

Physical goods exempt (for now)

Amazon's Kindle app, which had allowed in-app book purchases, was forced to remove its store entirely. Netflix, Spotify, and others scrambled to adapt. The message was clear: pay the tax or lose access to iOS users.

2012-2015: The Slow Squeeze

Restrictions on app updates and pricing changes

Bans on apps that "duplicate core functionality"

Rejection of apps that compete too directly with Apple

Introduction of Search Ads in the App Store reducing organic distribution and visibility

2016-Present: Maximum Control

Apple systematically builds features that kill popular apps

App Tracking Transparency decimates ad-based business models

App Store Small Business Program (15% commission) seems generous but comes with restrictions

Battles with Epic Games, Spotify, and regulators worldwide

Alternative app stores and side loading still forbidden

Today, Apple's control is absolute. Apple has made departure impossible. Want to reach iPhone users? You go through Apple. Period. The 30% tax that seemed reasonable in 2008 is now generating over $100 billion annually.

Google Search

Google's platform shift is unique—it took two decades to fully play out. While Facebook and Apple showed their cards relatively quickly, Google maintained the illusion of an open web for much longer.

In the early 2000s, search was fragmented. Yahoo served as the starting point for millions. AltaVista appealed to engineers. Microsoft pushed MSN Search. Dozens of specialized engines fought for relevance. Google was just another upstart with a clean interface and remarkably better results.

Step 1: Identifying the Moat

Google's moat was elegantly circular: data and content. The more people searched, the more data they gathered. The better their results, the more people searched. But this virtuous circle had a critical dependency—they needed the entire web's content.

Unlike Facebook or Apple, Google's moat required universal participation. They needed millions of websites creating content, structured in ways their crawler could understand. The open web wasn't just philosophy—it was a business requirement.

Step 2: Opening the Gates

Google's early philosophy bordered on religious devotion to openness. Larry Page captured it perfectly in 2004:

"We want to get you out of Google and to the right place as fast as possible."

This wasn't just rhetoric. It was the value exchange that built the modern web:

Create good content → Google sends free traffic

Optimize for their algorithm → Rank higher

Better content → More visitors

This spawned the entire SEO industry. Businesses were built on ranking #1 for valuable keywords. Publishers reached audiences without paying for distribution. Small sites could outrank giants with superior content.

For over a decade, it felt like genuine partnership. Google's revenue came from clearly marked ads in yellow boxes or sidebars. The main results remained sacred—organic, merit-based, untouchable. Ranking #1 organically was the holy grail of internet business.

Step 3: Closing for Control

Google's closure happened so gradually it felt like evolution, not strategy.

Phase 1 (2010-2015): The Ad Creep Ads moved from sidebar to prime real estate above organic results. Three to four ads became standard for commercial queries. Google killed keyword data with "not provided," blinding websites to their traffic sources.

Phase 2 (2015-2020): The Feature Takeover Featured snippets answered questions without clicks. Knowledge Graph pulled data without attribution. "People Also Ask" pushed organic results down. Local packs, shopping results, flight information—all Google products claiming more territory.

Phase 3 (2020-Present): The Closed Garden The Markup's 2020 investigation revealed the stunning reality:

41% of mobile first screen shows Google products

63% of visible first page is Google-controlled

1 in 5 searches show zero external results initially

Today, a commercial search reveals Google's true form. You'll see ads, then shopping results, then maps, then featured snippets, then "People Also Ask" boxes. Actual organic results? Maybe on scroll eight.

Google began competing directly in lucrative verticals. Travel queries that fed Expedia now show Google Flights. Product searches bypass Amazon for Google Shopping. Local searches favor Google Maps. Companies that spent decades building SEO-driven businesses watched their traffic evaporate—not because they got worse, but because Google decided to compete.

Google has essentially become a closed distribution ecosystem atop the open web: it still indexes the web, but it increasingly interposes its own monetized layers (ads) and products. SEO is no longer a guarantee of reach. Even if you rank well, you might be shown below a block of sponsored results and Google’s own info panels.

LinkedIn

LinkedIn's platform shift is happening right now, in real-time. It's also the fastest we've seen—from open to closed in less than four years. If you're a business content creator who's noticed your engagement plummeting, you're not imagining it. You're witnessing the playbook in action.

For most of its existence, LinkedIn was essentially a digital resume database. Users updated their profiles maybe once a year. Engagement meant accepting connection requests. But there was an internal mandate: transform LinkedIn from a static directory into a daily destination.

Step 1: Identifying the Moat

LinkedIn's moat is professional data—not just who you are, but what you do, what you care about, and how you behave professionally. This data is gold to three lucrative customer segments: marketers targeting B2B buyers, recruiters hunting talent, and salespeople seeking warm leads.

But static profiles only reveal so much. LinkedIn needed dynamic data—what you read, what you share, what makes you engage. They needed users actively participating, not just existing.

Step 2: Opening the Gates

Around 2020, LinkedIn made a strategic decision to prioritize "creator" content in the feed. The deal was irresistible: publish business content directly on LinkedIn, and they'd give you extraordinary organic reach.

The early results were staggering. Posts that would get 100 views on other platforms were getting 10,000+ impressions on LinkedIn. Some creators went from unknown to industry thought leaders in months. The algorithm seemed to love everything—text posts, native video, document carousels, polls.

LinkedIn sweetened the deal by launching Creator Mode, newsletter functionality, and live video. They actively courted business influencers to post exclusively on the platform. The message was clear: this is your new distribution channel.

For about two years, it was a content heaven. B2B marketers abandoned Twitter and blogs for LinkedIn posts. Sales teams trained executives to become "thought leaders." Everyone rushed to claim their piece of the organic reach pie.

Step 3: Closing for Control

The first signs of closure appeared in late 2022. Creators started noticing declining reach. Posts that once reached 50,000 professionals now struggled to hit 5,000. The algorithm became pickier, favoring certain formats while punishing others.

Then came the smoking gun: Thought Leader Ads.

Launched in June 2023, this new ad format allows companies to sponsor organic posts from individuals—turning executives and influencers into ad inventory. The implication was obvious: if you want reach, you'll need to soon start to pay for it.

The data confirms what creators feel. Social media agencies report LinkedIn organic engagement rates hitting all-time lows, with algorithm changes causing 50-75% decreases in reach for posts that previously performed well. The same content, the same creators, dramatically different results.

Today, LinkedIn's feed is starting to look more like driving down the 101. Sponsored content dominates. Organic posts are getting buried under "suggested posts" from people you don't follow. The creator economy LinkedIn built is being systematically monetized.

LinkedIn is a proof point that platform cycles are accelerating. What took Facebook five years and Google twenty years, LinkedIn accomplished in less than four. They've perfected the formula:

Create artificial scarcity: Make organic reach feel special and exclusive

Build creator dependence: Encourage people to abandon other channels

Flip the switch: Once critical mass is achieved, monetize aggressively

Gaslight the community: Claim the algorithm changes are about "quality"

The Impending New Distribution Channel: ChatGPT

By now, the pattern should be clear. Every major platform follows the same playbook: open, grow, close, monetize. My personal belief is that ChatGPT is the next distribution platform. I think it will happen within the next 6 months (and possibly faster). Even if it’s not ChatGPT, it will be someone else and the pattern will repeat.

Step 0: The Competitive Environment

Despite ChatGPT's 700 million users, we're still in a genuinely competitive environment. The AI model leaderboard changes monthly. OpenAI releases GPT-4, then Anthropic counters with Claude. Google launches Gemini. Meta open-sources Llama. DeepSeek emerges from nowhere with competitive benchmarks.

Users still have relatively low switching costs. Copy your prompt, paste it elsewhere, get similar results. There's no lock-in yet. No data gravity. No compelling reason to stay with one provider.

Some of you are probably screaming at the monitor about Claude, Google Gemini, Meta, and Apple as being in the market. But remember, Facebook wasn’t the biggest social network. Apple didn’t have the most popular phone. Google was surrounded by other search engines.

This is what this stage of the cycle always look like—before someone figures out the moat.

Step 1: Identifying the Moat

OpenAI has identified their moat, and it's not model quality. It's context and memory.

Think about what makes an AI assistant truly valuable. It's not just answering questions—it's understanding your specific situation, remembering your past conversations, knowing your preferences, and building on previous interactions. The AI that knows you've been working on a product launch for three months and can reference your previous discussions is infinitely more valuable than one starting from scratch each time.

From Aaron White (Founder of, Former CTO at Vendr) on a recent Unsolicited Feedback podcast episode:

“When AI is fully ingesting and memorizing everything you see and have seen it can begin promoting information to you w/o you even prompting. That requires long term, massive memory- and it’s clear between baby-memory, MCP, and their desktop app which has hooks to “see what you see” they are heading down this path.”

The key here is that MCP only addresses context portability, not memory. The accumulated history of interactions, the learned preferences, the refined understanding of each user—that's not portable. And that's where the real lock-in lives. OpenAI seems to be moving fastest on this.

This is different from previous platform moats. Facebook needed your social graph. Google needed the web's content. OpenAI needs something far more intimate: your entire digital context. Every document, every conversation, every preference, every workflow.

Step 2: Opening the Gates

They can't capture this context and memory alone. No single company can build integrations with every tool, access every data source, or understand every workflow. So we're seeing the early signs of platform opening.

There are a few early signals that they are about to open the gates:

They recently launched connectors w/ Deep Research to tools like HubSpot, Box, GitHub, and more.

They're hiring aggressively for their Agent Platform/Infrastructure team, including “Product Manager, Agent Platform” with job postings explicitly stating they're building "the platform and integrations to launch new agents to hundreds of millions of users worldwide."

Each of these integrations and agents will provide more context to create more usage and enable OpenAI to capture more memory increasing the moat. We’ll have to see how the value exchange between OpenAI and developers will be constructed.

Remember, they’ve already attempted this twice. First with GPT store promising monetization was coming (but never did). Then with plugins, which they shut down. They are looking for the right formula.

Step 3: The Inevitable Closure

Once OpenAI achieves context lock-in, when switching to another AI means losing months or years of accumulated context, the platform dynamics will likely shift.

The first changes will be subtle. Maybe a "ChatGPT Platform Fee" for high-volume integrations. Perhaps preferred placement for "certified partners" who pay. Possibly restrictions on what types of data can be accessed or how it can be used. Or a platform tax like Apple leverages on the mobile ecosystem.

Then comes the feature absorption. The most successful use cases built on the platform will be "simplified" into native ChatGPT features. They’ve already done this around use cases for critical context (i.e. Glean and Granola). Why use a third-party research tool when ChatGPT Pro includes it? Why maintain a separate workflow automation when ChatGPT Actions handle it natively?

The worst-case scenario would be a complete platform shutdown. They have the context, the users, the habit. They pull a Facebook: revoke API access (or Twitter - see Meerkat), build everything in-house, leave a trail of dead startups in their wake.

Are these platforms “evil?”

I want to be clear. I’m not implying OpenAI is “evil” or deliberately planning this from the start. It’s just the reality. The cycle always ends the same.

The cycle emerges from natural competitive dynamics within capitalism. Companies exist to grow. To grow they need to gain a competitive advantage. This competitive environment in capitalism creates an incredible amount of consumer value. Time and energy spent thinking about how this cycle may be unfair is misdirected. You should re-route that energy to understanding the rules of the game and how to participate.

Why OpenAI / ChatGPT Over Others?

OpenAI is showing many signals they are about to make this move. Claude, Google, and others could make a similar move. So why is my prediction on OpenAI?

If you are a Reforge alum, you should have one thing burned into your brain - those with the highest retention & engagement win categories. Retention is the god metric. It is a universal law at this point and has been proven over and over.

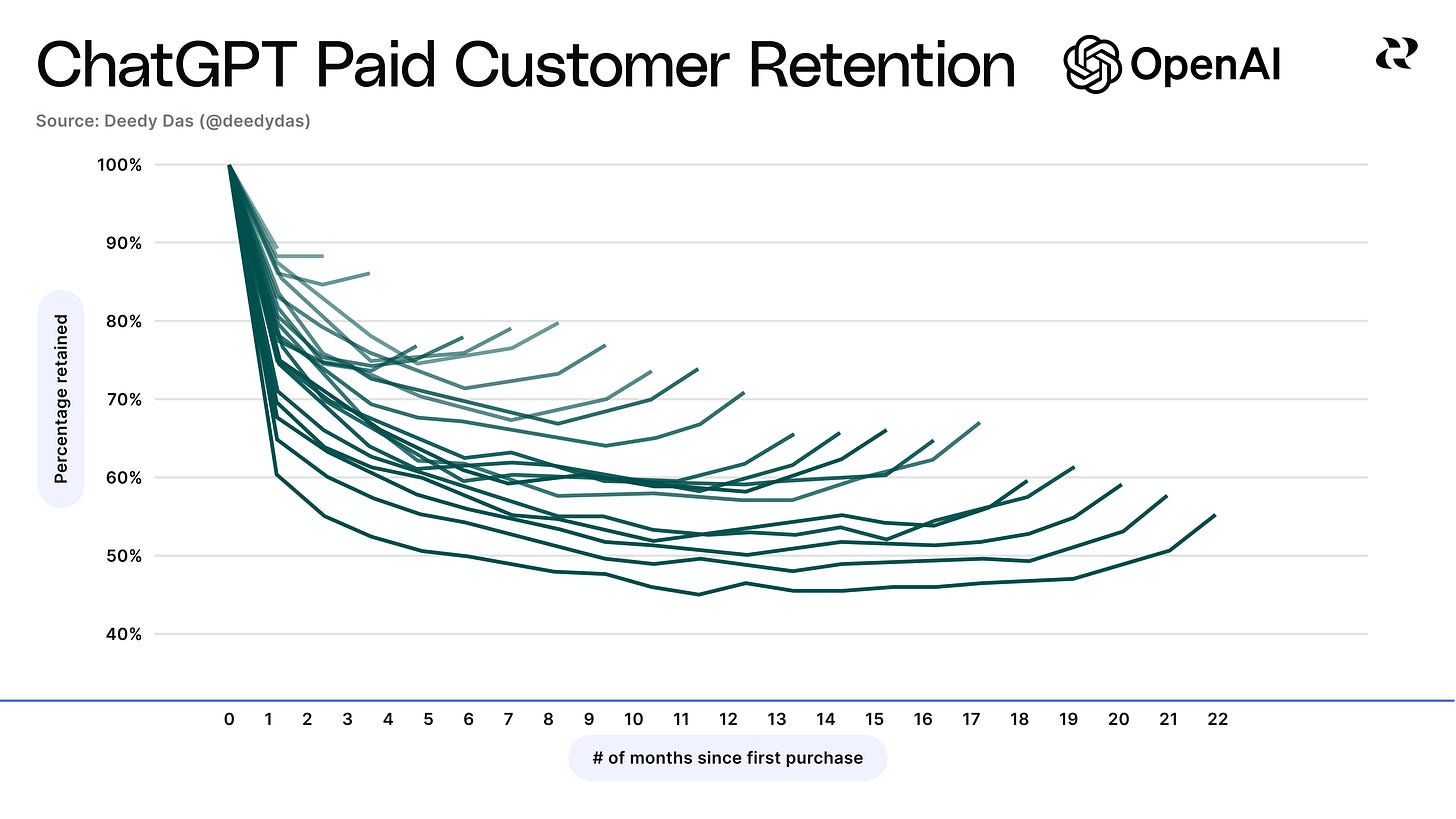

ChatGPT clearly has the highest retention. Deedy Das, VC at Menlo Ventures recently posted this data. What do you see?

I see three things:

They have the highest mean customer retention vs others in the category.

Their retention curves have been shifting up over time.

They have attained the rare and magic “smile curve” of retention.

The only other times I have seen this pattern is in retention curves of products like Facebook, LinkedIn, and Slack. I’ll repeat, it does not matter that Google / Meta have access to larger distribution if the retention & engagement disparity is this large.

It will fuel the engagement loops that will drive integrating more context and capturing more memory. It will also attract more developers and builders to their inevitable platform fueling it even more.

The Accelerating Timeline

Casey Winters observed something:

"With every generation, companies that reach massive scale have gotten more efficient at preventing other companies from growing on top of them, at least for free."

Google let SEO flourish for two decades. Facebook gave developers five years. LinkedIn managed less than four. How long will the AI window last? My bet: two years. Maybe less. They've learned from history. They know the playbook. They'll move faster than anyone expects. The stakes are much larger.

The integration requests, the MCP protocol, the agent platform—these aren't just features. They're the early moves in a platform play that will reshape software distribution. OpenAI isn't building an AI assistant. They're building the next destination, the next App Store, the next search engine, the next social network—except this time, the moat isn't a social graph, user generated content, or connections. It's context and memory. And once they have yours, switching will become almost impossible.

There Is No Opt’ing Out

Here's the uncomfortable truth: knowing the game doesn't mean you can opt out.

Every product leader faces the same dilemma. In isolation, integrating with ChatGPT makes no sense. Why would HubSpot want to become a database to ChatGPT's interface? Why would Notion want to feed their replacement? Why would any company voluntarily feed the next platform monopoly?

But we don't operate in isolation. We operate in competitive markets. And markets are ruthless about efficiency.

When your competitor integrates with ChatGPT and their users love the AI-powered experience, what choice do you have? When customers start asking why your product doesn't work with ChatGPT like your rival's does, what's your response? When the trade press writes about how you're falling behind in the AI revolution, what's your strategy?

This is the prisoner's dilemma of platform shifts. Everyone knows how it ends, but everyone still plays because the alternative—letting competitors claim the early advantage—is worse.

The window is opening now. ChatGPT will soon cross a billion monthly active users. The competitive environment has peaked. The early integrations will get preferential treatment, better placement, and deeper access. They'll shape the platform rules. They'll build the habits. They'll capture the value before the taxes arrive.

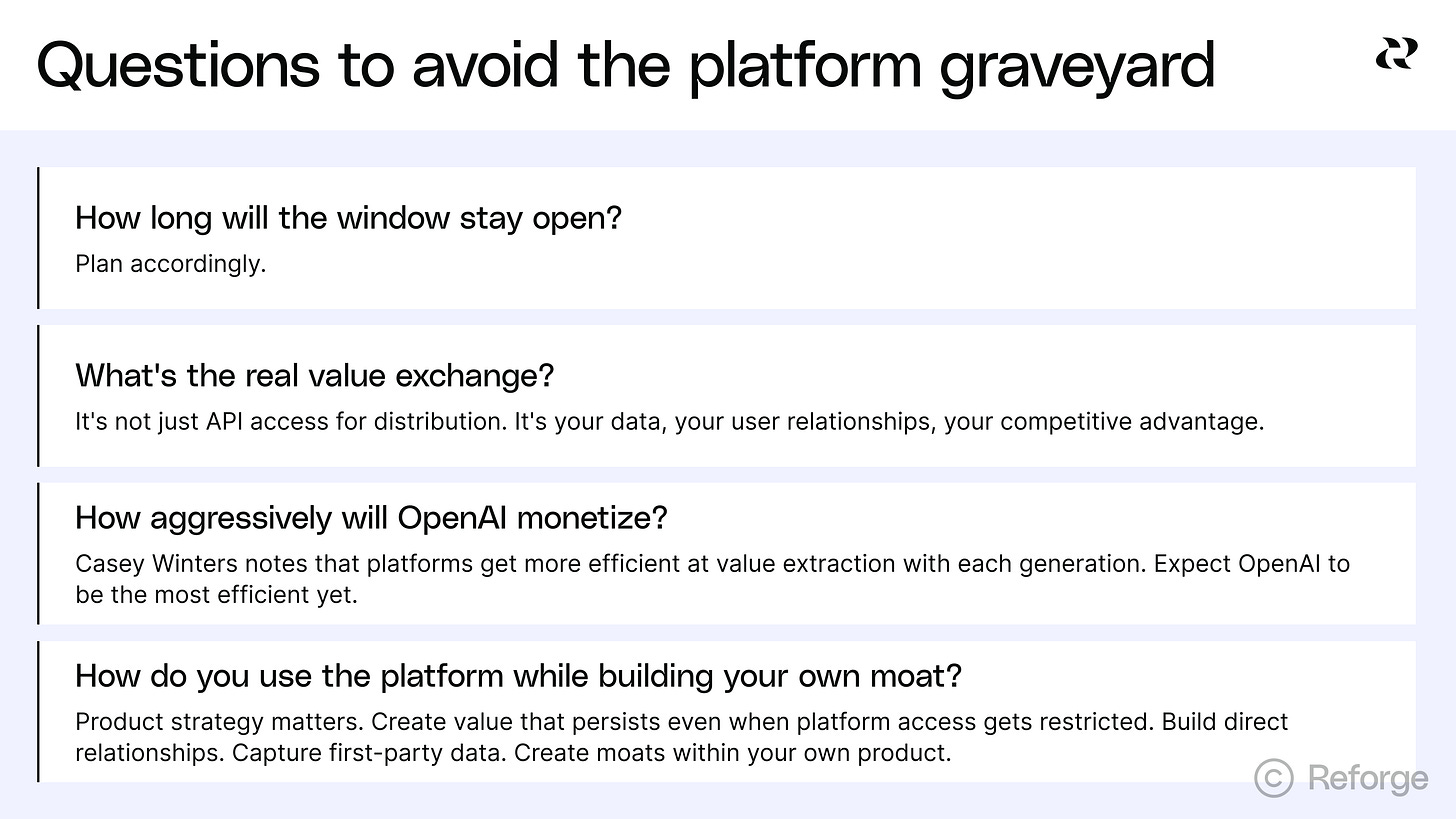

But rushing in blindly is how you end up in the platform graveyard. The smart players are already asking the critical questions:

How long will the window stay open? Plan accordingly.

What's the real value exchange? It's not just API access for distribution. It's your data, your user relationships, your competitive advantage.

How aggressively will OpenAI monetize? Casey Winters notes that platforms get more efficient at value extraction with each generation. Expect OpenAI to be the most efficient yet.

Most importantly: How do you use the platform while building your own moat? This is where product strategy matters. You need to create value that persists even when platform access gets restricted. Build direct relationships. Capture first-party data. Create moats within your own product.

The companies that survived previous platform shifts didn't just integrate—they integrated strategically. They used Facebook's viral channels while building email lists. They leveraged Google's traffic while developing brand loyalty. They sold through the App Store while creating web experiences.

This time won't be different. Use ChatGPT's distribution, but don't depend on it. Let their AI enhance your product, but don't let it become your product. Most importantly, assume the platform will turn hostile and plan accordingly.

The stampede is coming. If I’m right, in six months, it’s likely every SaaS product and consumer application will be rushing to complete a ChatGPT integration. In twelve months, users will expect it. In eighteen months, the platform taxes will arrive. In twenty-four months, the graveyard will be full.

If you’ve gotten to this point in the essay, you can see it coming. You understand the pattern. You know the game. The only question left is whether you'll play it with your eyes open or closed.

Because in platform shifts, there are only three types of companies: those who move too early and waste resources, those who move too late and miss the window, and those who see the shift coming and position themselves to win. If you end up in the graveyard, it’s not ChatGPT’s (or whoever is the platform) fault. It’s yours.

The clock isn't just ticking, it's accelerating. And in this game, the house always wins.

But if you play it right, you can win too—at least for a while.

Choose wisely. Move deliberately. And whatever you do, don't be naive.

The next great distribution shift isn't coming. It's here. And whether you're ready or not, you're already playing.

Appendix: How This Prediction Could Be Wrong

Let me be clear about what I'm predicting here. I give it 80% odds that ChatGPT/OpenAI becomes the next major distribution platform. But I'm 100% certain that whoever wins will follow the same open-grow-close pattern we've documented. The cycle is too proven, too profitable to abandon.

Still, predictions are humbling, and there are legitimate reasons why ChatGPT might not be the one. Let's examine them honestly.

Apple Gets Their Act Together

Apple is the sleeping giant that could change everything. They own the device layer—both mobile and desktop. They see every interaction, every app, every moment of your digital life. They have the ultimate context and could build the ultimate memory.

As Aaron White said on Unsolicited Feedback:

“If you own the device, you see everything the user sees — that’s why Apple is in the best position.”

If Apple suddenly shipped a compelling AI assistant that leveraged all that context, integrated with all their services, and opened it to developers, they could leapfrog everyone. They have the users, the developer relationships, and the platform experience.

But "if" is doing heavy lifting here. Apple's AI efforts have been underwhelming (and that is putting it politely). Their culture prioritizes privacy over the data collection that powers AI. Their famous secrecy conflicts with the developer openness platforms require.

OpenAI clearly sees this threat—hence their reported device collaboration with the acquisition of Jony Ive. They're not waiting for Apple to wake up.

OpenAI Fumbles It

This is the most likely failure mode. OpenAI could absolutely blow their advantage by moving too aggressively, too fast. They're already pushing boundaries competing with enterprise players like Glean, and launching copycat features like meeting recording.

If they get too greedy too quickly, they could create an opportunity for one of the competing players to come in with a more friendly platform. But remember, ChatGPT has the user advantage at 700M MAU’s and growing.

OpenAI Already Has Escape Velocity And Doesn’t Need A Platform

One possibility is that OpenAI already has enough escape velocity on ChatGPT and doesn’t need to create a platform to hit it. That might be true in isolation, but once again we live in a competitive environment. The rational thing for Claude, Google, others to do in this case is to build a platform themselves in order to accelerate their growth and compete. As a result, I think ChatGPT/OpenAI launches their own just to cement victory and stave off the competitive move of others.

MCP Makes Context More Portable

Anthropic's Model Context Protocol was a clever defensive move. In theory, it commoditizes integrations—if every AI can access the same context through standardized protocols, no single platform can monopolize it. It's like making phone numbers portable between carriers.

But theory isn't reality. Developers and businesses are resource-constrained. They'll focus on the largest platform first, and ChatGPT has at least 20X Claude's user base and is growing faster. Even if every AI platform launched identical integration capabilities tomorrow, the rational move is to optimize for ChatGPT's 700 million users, not Claude's 30-40 million.

This creates a compounding advantage. More integrations make ChatGPT more valuable. More value attracts more users and deepens engagement. More users attract more integrations. We've seen this movie before.

Plus, MCP only addresses context portability, not memory. I’ll repeat - the accumulated history of interactions, the learned preferences, the refined understanding of each user—that's not portable. And that's where the real lock-in lives.

There Are Major Other Players With Lots of Distribution

Microsoft has Copilot embedded across Office. Google has Gemini integrated everywhere they plaster the icon. Apple has... well, they're trying. Couldn't any of these giants become the platform instead?

Remember: Facebook wasn't the largest social network when it launched its platform. The iPhone wasn't the market leader when the App Store arrived. What matters isn't size—it's engagement depth, platform readiness, and trajectory.

We’ve seen the retention numbers. My hypothesis is that if we could see the engagement numbers between platforms, ChatGPT has the deepest engagement. They're creating the kind of deep engagement that makes a platform valuable to developers. Microsoft users might encounter Copilot, Google users might encounter Gemini CTA’s, but do they build their day around it?

Depth beats breadth in platform dynamics. Facebook had far fewer users than Myspace, hi5 or Friendster, but their users were addicted. That addiction—that depth of engagement—is what developers and creators want to tap into.

Regulation

This is the true wild card. The regulatory environment around AI is volatile and unpredictable. Data privacy laws, AI safety regulations, antitrust enforcement—any of these could derail a platform play.

Europe might decide that accumulating user memory is fundamentally anticompetitive. The US political environment has been on an absolute rollercoaster the last couple of years.

Regulation could slow the platform shift, fragment it geographically, or even prevent it entirely. But betting against technology platforms finding ways around regulation is historically a losing proposition. They'll adapt, lobby, and innovate their way through.

OpenAI’s Land Grab on Unsolicited Feedback

I first discussed the above concept with Fareed Mosavat and Aaron White on Unsolicited Feedback. Here is the full episode: YouTube :: Apple :: Spotify

Has anyone else thought about how this applies to Substack as a platform?

First we get the 'everyone can make a free newsletter' + Notes as a new 'news feed'...

Maybe we'll soon start seeing sponsored Notes being the only ones to show up, having to pay for access to our subscribers, etc..

Such a refreshing take on where we are heading with the next big technological shift. I do wonder about how this shift will transform (or not) the ads and sponsored content ecosystem. I've always found it sad that ads have permeated every single corner of the digital experience. The naïve in me wants to believe this new platform will decrease the exposure we have to ads. The reason is because ads have been the solution to monetizing what is free access to current platforms (Google Search, Facebook, LinkedIn...). But with LLMs, my guess is that there will be a higher percentage of paid users, which will make the need to have ads as a key to monetization less important. However, the cynical in me thinks we will start seeing "sponsored" responses or "sponsored" recommendations included in the LLM's outputs. And at that moment we are back to where we are today...

Any takes on the future of ads in this context, Brian?