The Four Fits: A Growth Framework for the AI Era

Everything's changed. Here's how to reach $100m at venture speed.

Reforge’s Fall Cohort of AI courses starts October 14th, including guests from OpenAI, Canva, GitLab, Descript, Laurel and many more. Enroll now to secure a spot.

AI Growth | AI Leadership | AI Strategy | AI Foundations | AI Productivity | All Courses

It’s been 10 years since I first wrote about the Four Fits. It’s the most popular piece I’ve ever written and something I refer back to in almost every strategy conversation I have.

While the framework still holds, AI has massively changed each of the four elements as well as how they fit together. It was clear that I’d need to update it based on AI and its halo effect, but I only just now feel that I have enough clarity to do so. In some ways, it’s amazing it lasted ten years without needing an update. Now, it’s obvious that it does and I hope this refresh helps you sort through some of the noise out there today.

In this post, I’m going to run through the Four Fits. I’ll summarize the framework, look at how some of the best companies of the AI era lean into the model, and talk through a few important ways that AI alters it.

The Four Fits: A quick refresher

Before we examine how AI disrupts the Four Fits, let’s establish our foundation. In order for a company to reach $100 million at venture speed, it must achieve all four. As I wrote in the original piece, when all four click, growth comes easy:

These companies grow despite having organizational chaos, not executing the “best” growth practices, and missing low-hanging fruit. I refer to these companies as Smooth Sailers - a little effort for lots of speed.

In other companies, growth feels much harder. It feels like pushing a boulder uphill. Despite executing the best growth practices, picking the low-hanging fruit, and having a great team, they struggle to grow. I refer to these companies as Tugboats - a lot of effort for little speed.

Everyone knows about Product Market Fit. And while it is one of the Four Fits, it’s only one of them. In the startup world, truisms like “Product Market Fit is the only thing that matters” have become common. Again, important but not the end-all-be-all.

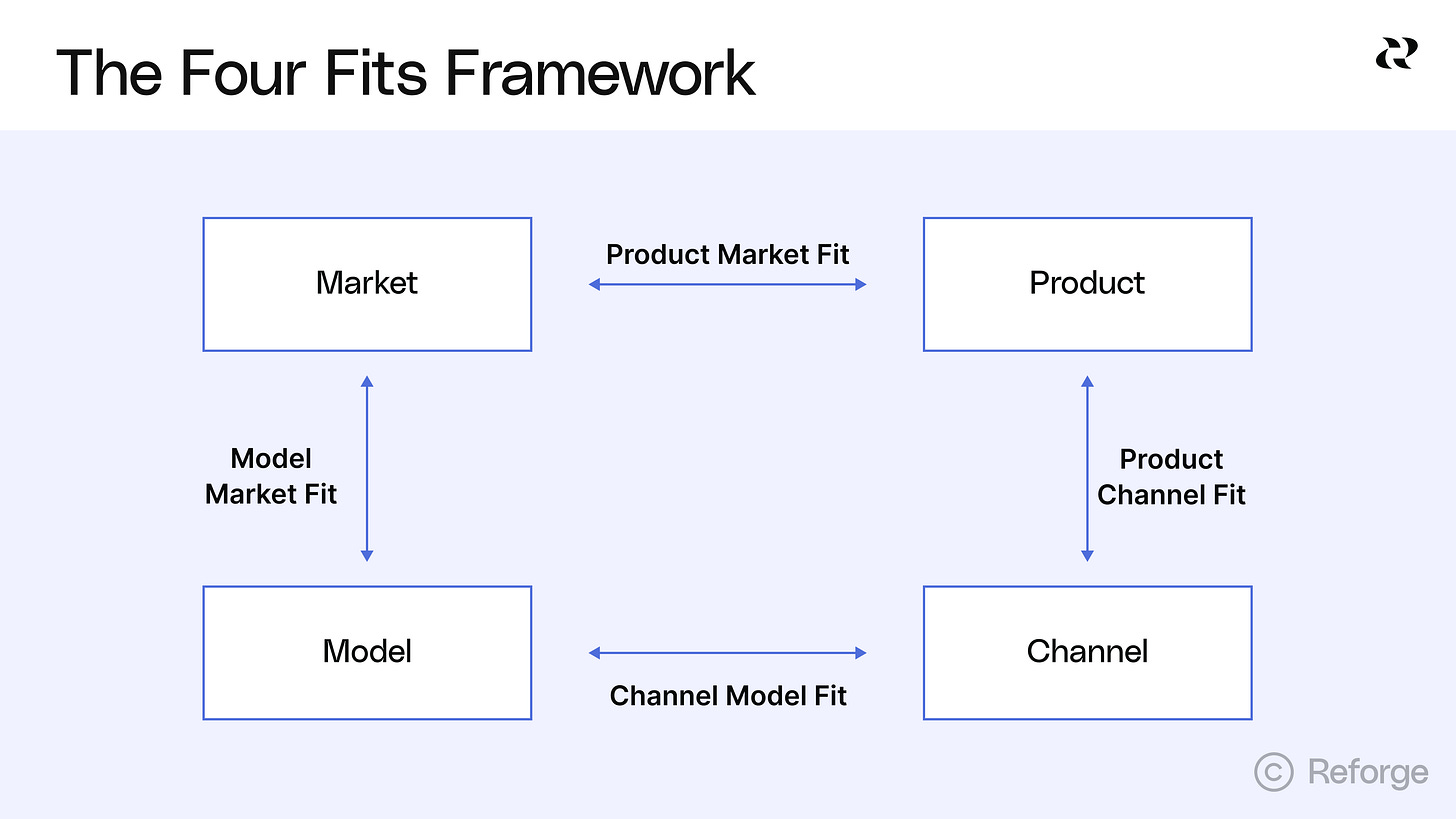

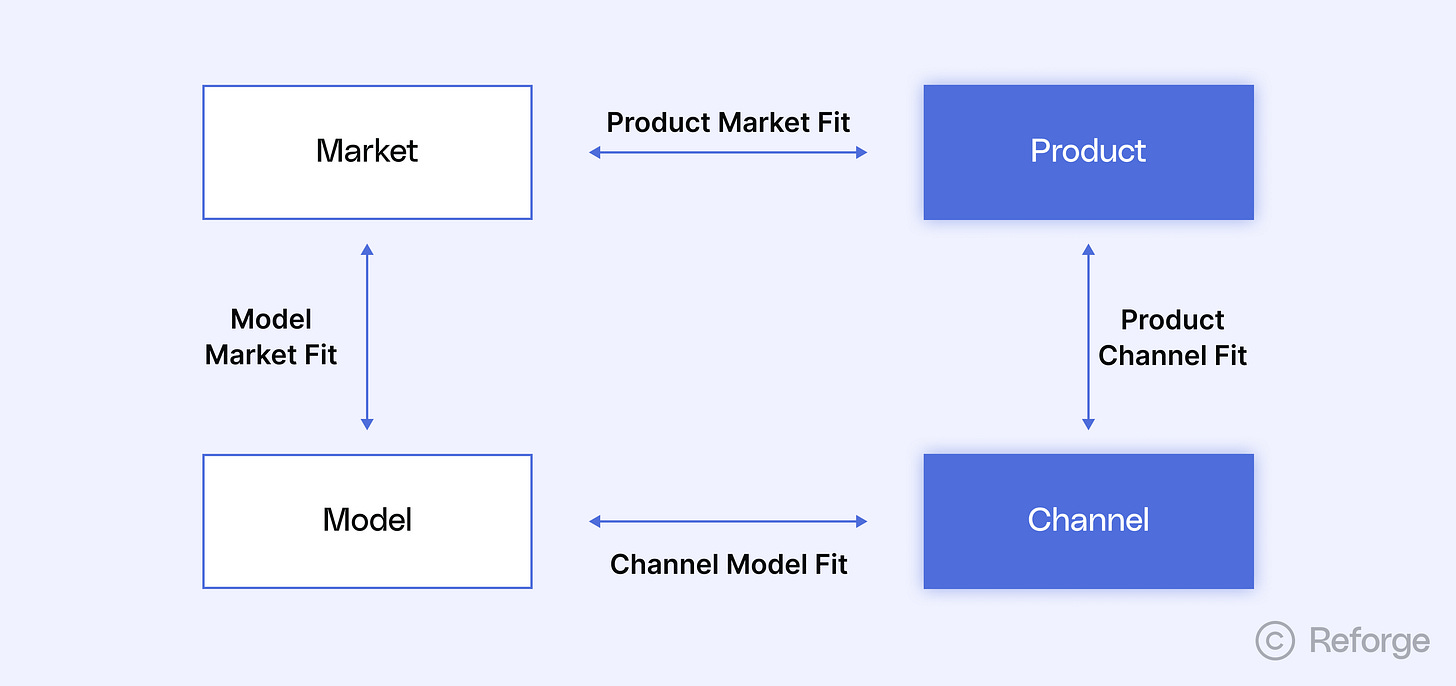

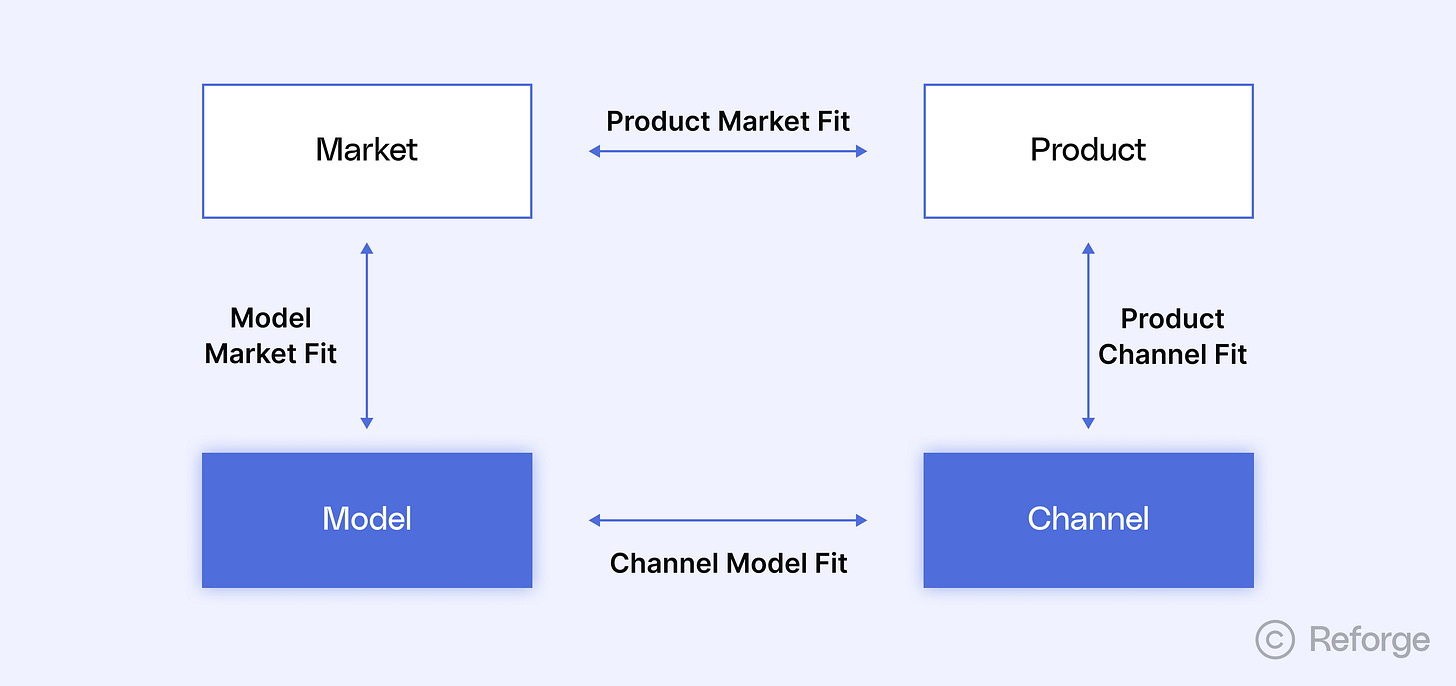

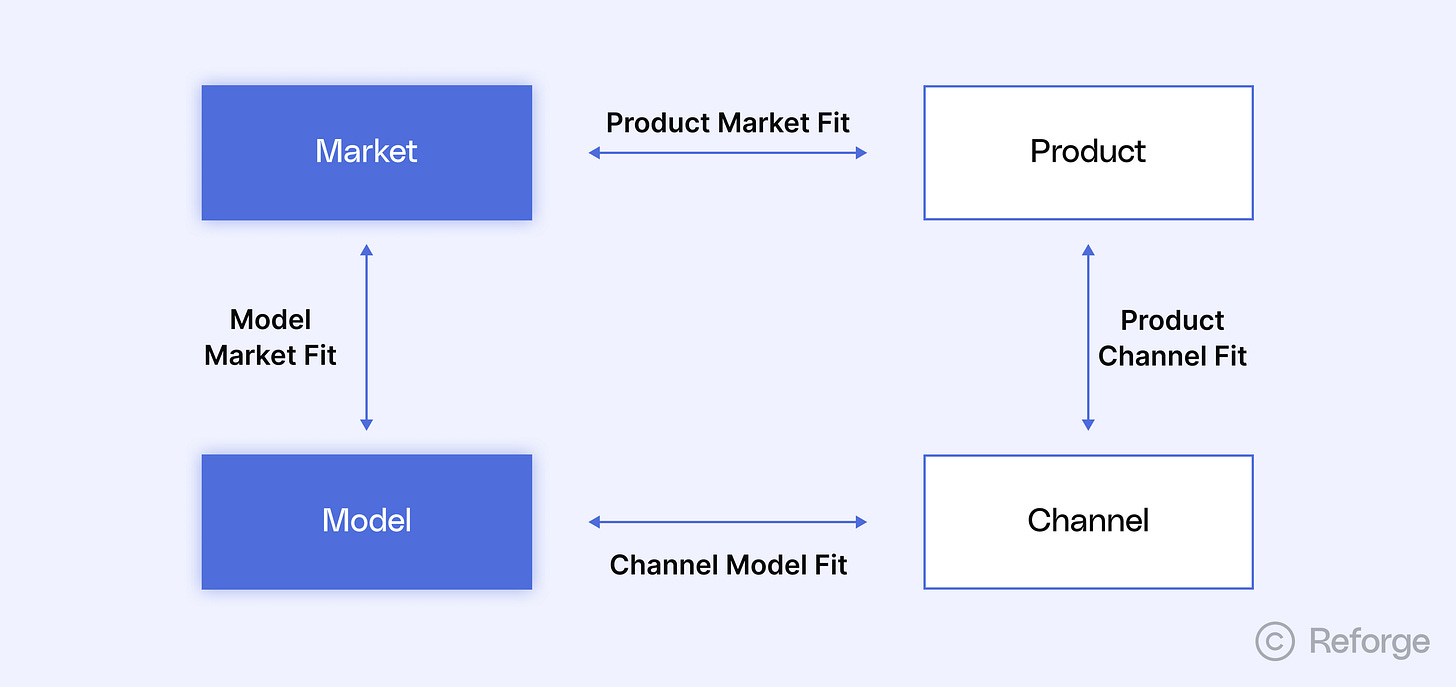

Successful products require alignment across four distinct but interconnected dimensions. These are the Four Fits:

Product Market Fit occurs when you build something that a meaningful segment of customers desperately wants. This is the classic definition most product leaders know. As Marc Andreessen wrote, you know you have it when “the customers are buying the product just as fast as you can make it -- or usage is growing just as fast as you can add more servers.”

Product Channel Fit recognizes that products must be built for the channels where customers discover them (channels do not mold to products). TikTok wasn’t just built for short-form video—it was specifically architected for mobile consumption and social sharing. Pinterest, TripAdvisor, and others were architected specifically for search. The products reflect the channel’s constraints and opportunities.

Channel Model Fit ensures your business model economics work with your chosen distribution channels. A freemium product with $10/month pricing can’t succeed through enterprise sales teams, just as a $50,000 annual software license can’t rely on viral social media growth.

Model Market Fit confirms that your chosen business model aligns with how your target market prefers to buy and pay for solutions. Most importantly, that alignment adds up to a $100 million+ potential revenue product (e.g. 100,000 customers paying $1,000 per year).

You can read the original series here: The 4 Growth Frameworks You Need to Build a $100 Million Product.

How AI changes growth: product, market, channel, model

In the first post of that series, I wrote that, “The fits are always evolving/changing/breaking. When that happens, you can’t simply change one element, you have to revisit and potentially change them all.” Change was always anticipated but on a timeline that provided enough time to analyze and react. There are several changes influencing the Four Fits right now, and they are happening at unprecedented speed.

Here is an overview of each of the components and the major underlying change in each.

Product

AI increases both the problem space and the solution space. You can now solve problems that you couldn’t previously and you can offer new solutions to old problems that couldn’t previously be solved

And these aren’t incremental possibilities, they are exponential. Like I said earlier, LLM capabilities are doubling about every seven months, which means the problem and solution space will continue to increase dramatically. Just imagine a scenario where a task that currently takes your customers eight hours to complete is handled entirely by an agent. Then think about 40 hours, 80 hours, etc. This is the type of change that’s coming over the next few years.

As you expand to solve new problems, you’ll need to find new Product Market and Product Channel fits. It’s not a given that more or better solutions translate directly into a fit.

Market

AI is expanding some markets and shrinking others. Canva always pitched itself as a design tool for everyone, but its TAM is exploding. Its free plan says it’s “For designing or working on anything.” And now that users can describe a design rather than dragging shapes and picking colors themselves, it’s actually true. AI app building tools like Lovable and Bolt turned the niche “no-code” market into a massive one.

On the other side, the homework help tool Chegg watched its Product Market Fit collapse in just a few months. Seat-based customer support tools are suddenly selling to companies with fewer support employees. Today, AI augments support but for some companies, it could eliminate the human factor altogether.

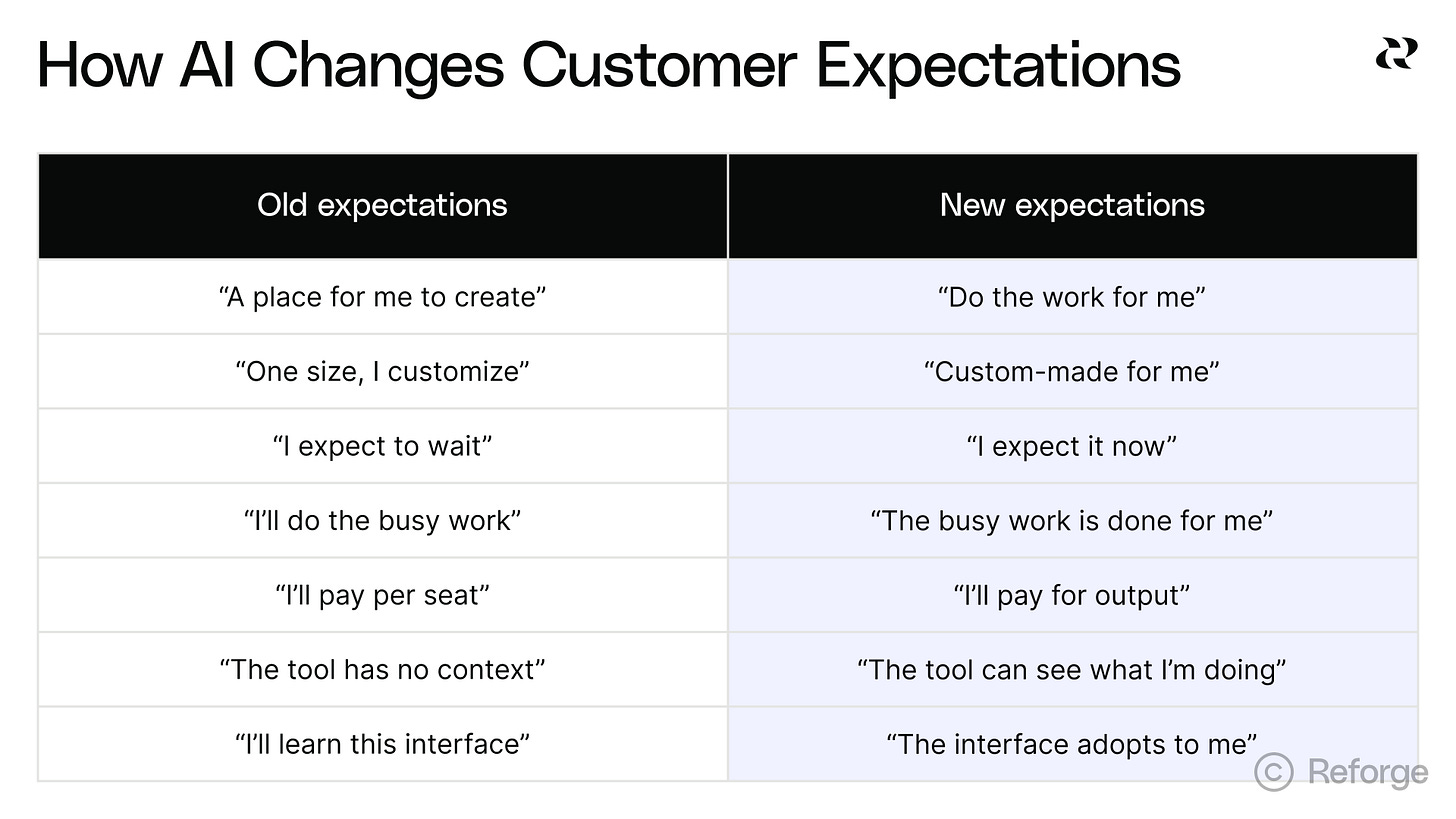

My podcast co-host Fareed Mosavat says that so many of the things we used to count on feel like quicksand. Markets reflect customer expectations, and those are changing quickly. If a person uses and likes ChatGPT, it changes their expectations of other products too.

One other change in markets is that AI democratizes skills that were usually reserved for specialists. AI can help non-technical people create apps, non-designers generate beautiful images, or someone who has no video editing skills make an eye-catching video. This democratization of skills expands markets and potential TAM for many products.

Channel

As I wrote in The Next Great Distribution Shift, we’re living through one of the most significant technology shifts in history, yet we’re still distributing products like it’s 2015. SEO traffic is down across the board. Social sites are walled gardens. PPC platforms are cashing in on the bleakness. In other words, the old playbooks are burning.

This is partially due to AI but also part of a natural cycle where companies incentivize users with free/cheap distribution and slowly close it off over time. The cycle looks like this:

Identify the Moat: Every platform starts by figuring out what will make it unassailable. The social graph for Facebook, search data for Google, and an app ecosystem for Apple.

Open the Gates: Next, platforms create “open” ecosystems, practically begging developers to build on top of them. Free API access. Viral growth mechanics. Revenue sharing that seems too good to be true.

Close for Monetization: Eventually, the rules change. What was free becomes paid. What was permitted becomes restricted. The platform starts competing with its own developers, often killing the very businesses that helped it grow.

We’re at a moment in time when most of the best distribution options are firmly in the third phase of this cycle. But a change is coming and I predict that ChatGPT will be the next big distribution opportunity, both through AEO/discovery and possibly a developer platform.

Model

Your model is (1) how you charge, (2) when you charge, (3) what you charge for, and (4) the amount you charge. There was plenty of nuance here prior to AI and most companies are still tinkering with pricing to figure out how to monetize AI. There are at least three new dynamics at play:

Cost to serve is increasing: Many SaaS tools relied on PLG partially because the cost to serve free/freemium users was marginal. LLM costs vary wildly and can be significant. Bearing this new cost can break the economics of free/freemium products.

Token usage is increasing: Heavier tasks eat up more tokens. Additionally, users overwhelmingly prefer the latest LLM models, even though previous ones are far cheaper. As TextQL founder Ethan Ding wrote, “GPT-3.5 is 10x cheaper than it was. It’s also as desirable as a flip phone at an iPhone launch.” Falling tech costs won’t fix your economics because they aren’t falling.

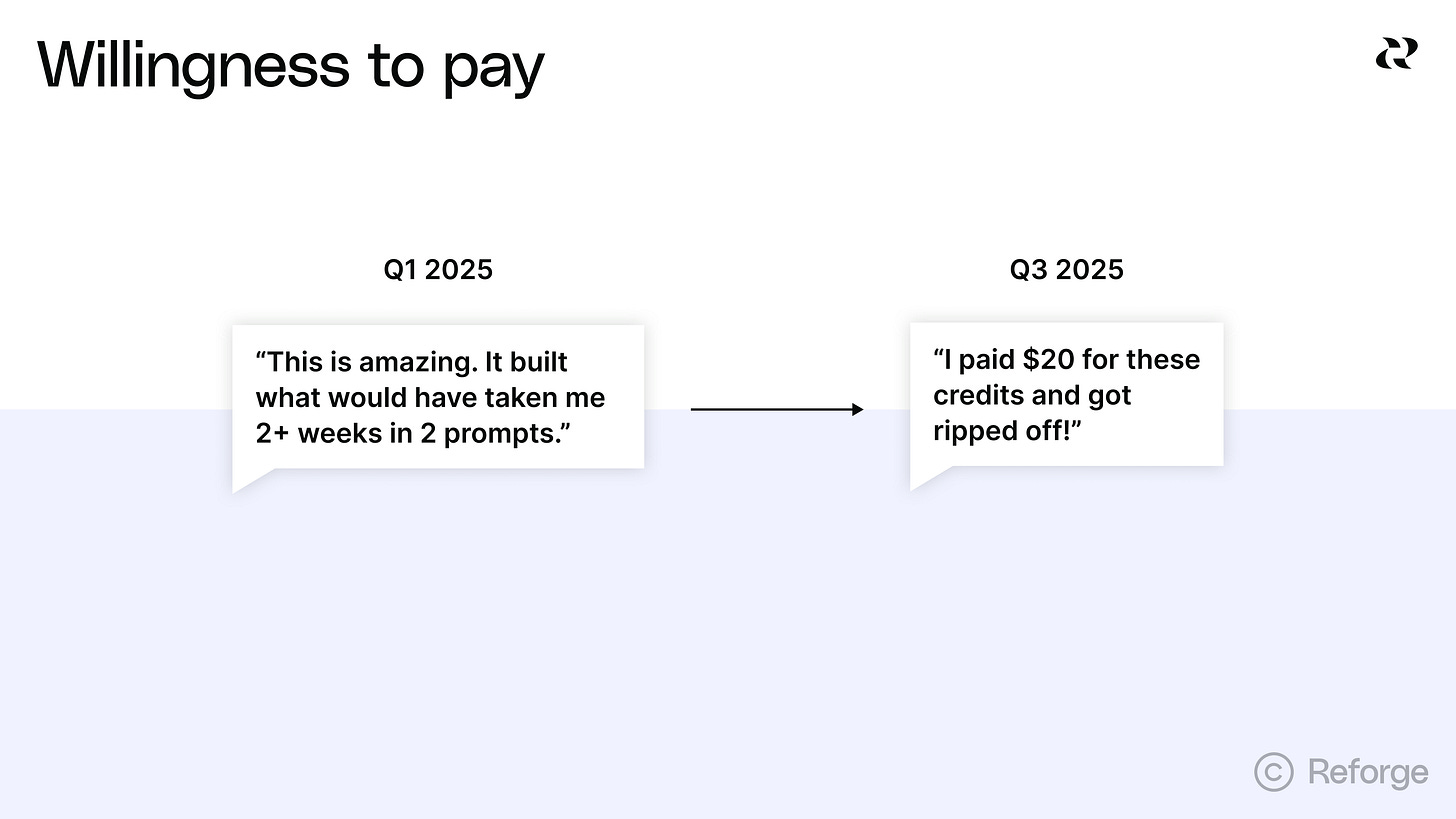

Willingness to pay is up in the air: The magic of some AI tools is wearing off. It’s unclear exactly how users will perceive the value of products like this as the initial awe fades into a new baseline expectation. You can pretty quickly gauge the change in sentiment on the Cursor subreddit. It looks something like this:

Customer demand for AI is insanely high, but that doesn’t automatically translate into profit or sustainable businesses.

What happens when AI changes everything all at once?

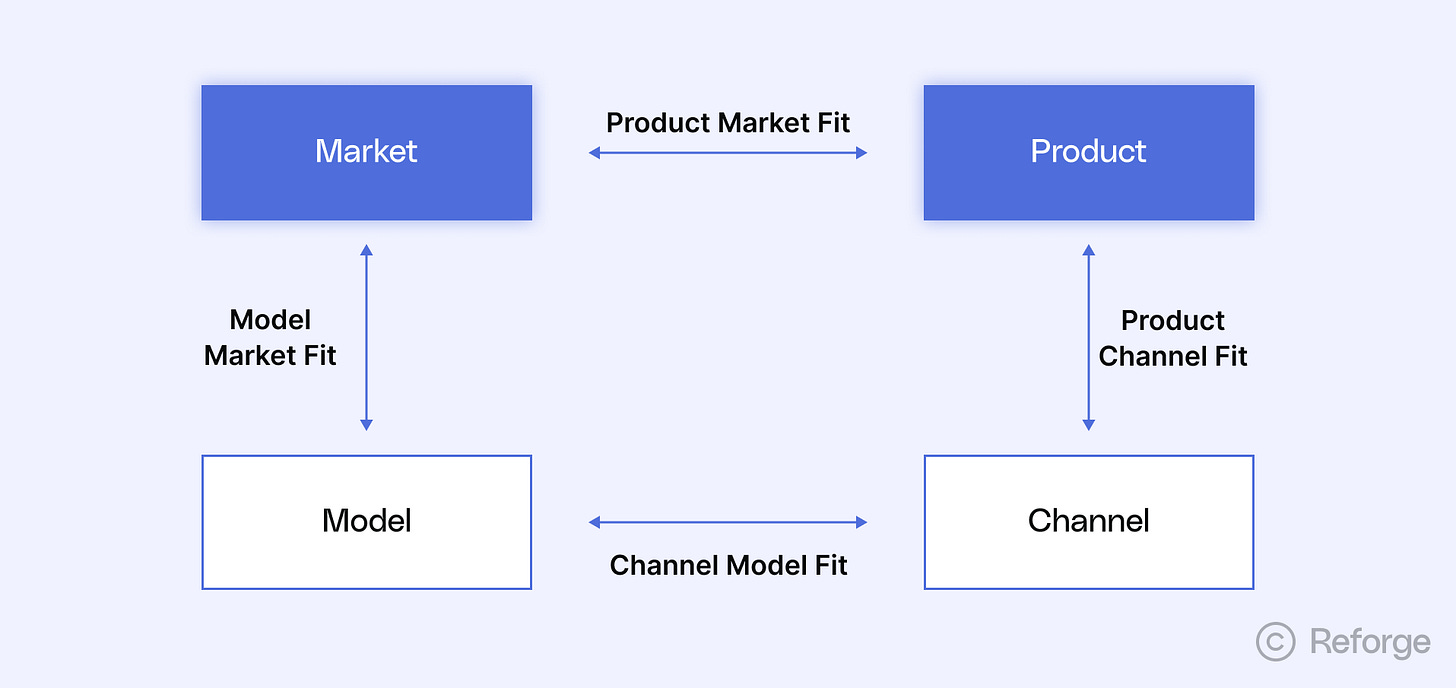

I can’t emphasize enough how much each of these fits influences each other. I’ve just described them in isolation but in practice they all must be in harmony. Without that harmony, you have almost no chance at becoming a $100 million+ company.

Let’s take a look at how each fit is changing.

How Product Market Fit changes

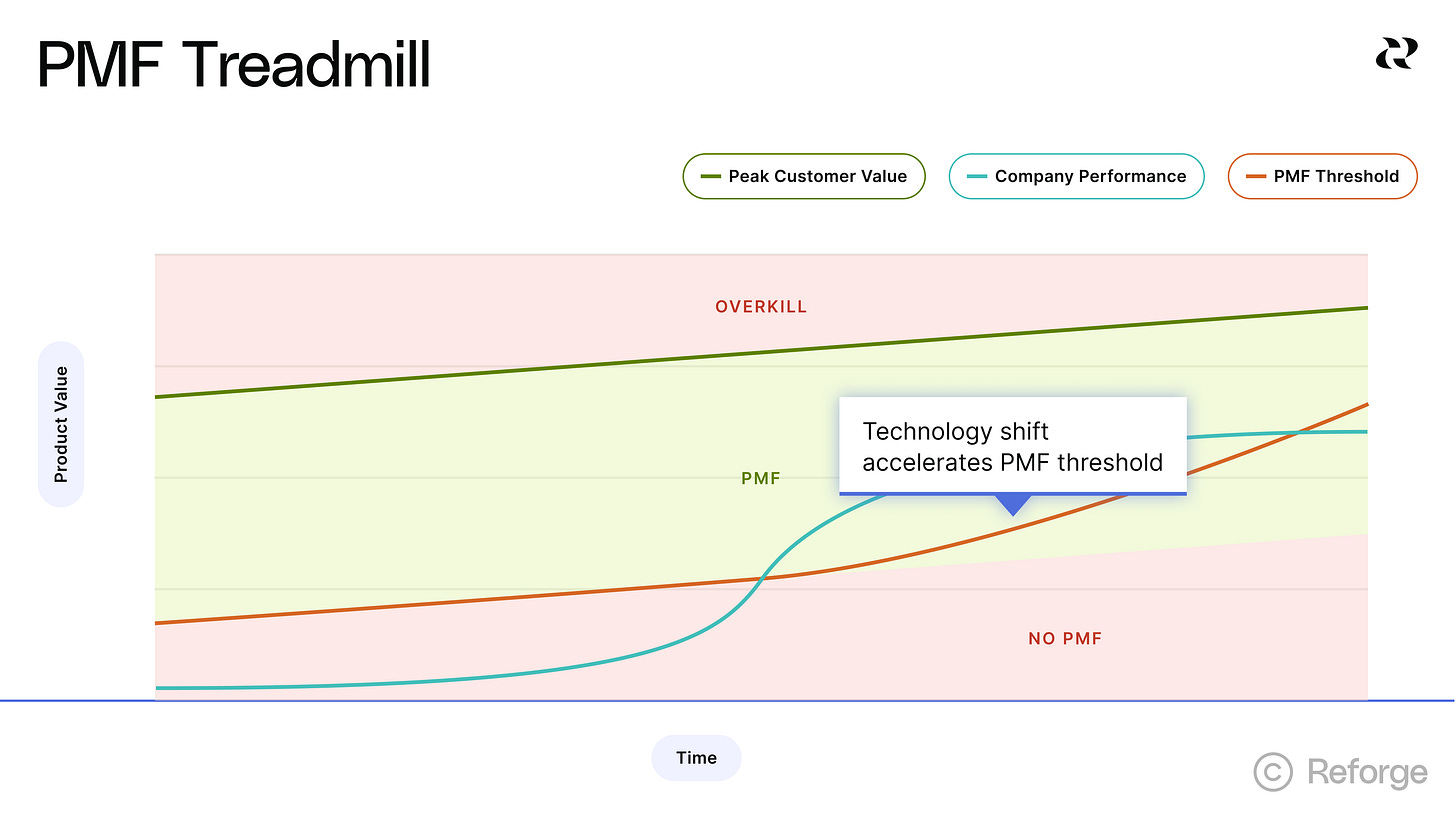

Companies can find and lose product market fit almost instantly. It’s important to remember that Product Market Fit is only a moment in time. Changing market conditions and new technology have always forced companies to refine their offerings to keep the fit. But changes were gradual enough that they had time to assess and roll out features to keep pace.

For example, in the mobile shift:

New technology capabilities happened in yearly cycles.

It took time for an ecosystem of developers to emerge around mobile.

It took years for a big enough audience of people to adopt the devices and have fast enough data plans for the new use cases to emerge.

The time between new tech capability and customer expectations increasing was multiple years at a minimum. This “slow” acceleration gave companies breathing room to adapt.

But something different is happening with AI. The time between these steps in AI is much faster.

New AI tech capabilities are being launched monthly, if not weekly.

There is a massive ecosystem of developers around this new tech already and growing.

Distribution of this tech to hundreds of millions has happened fast, cheap, and freely.

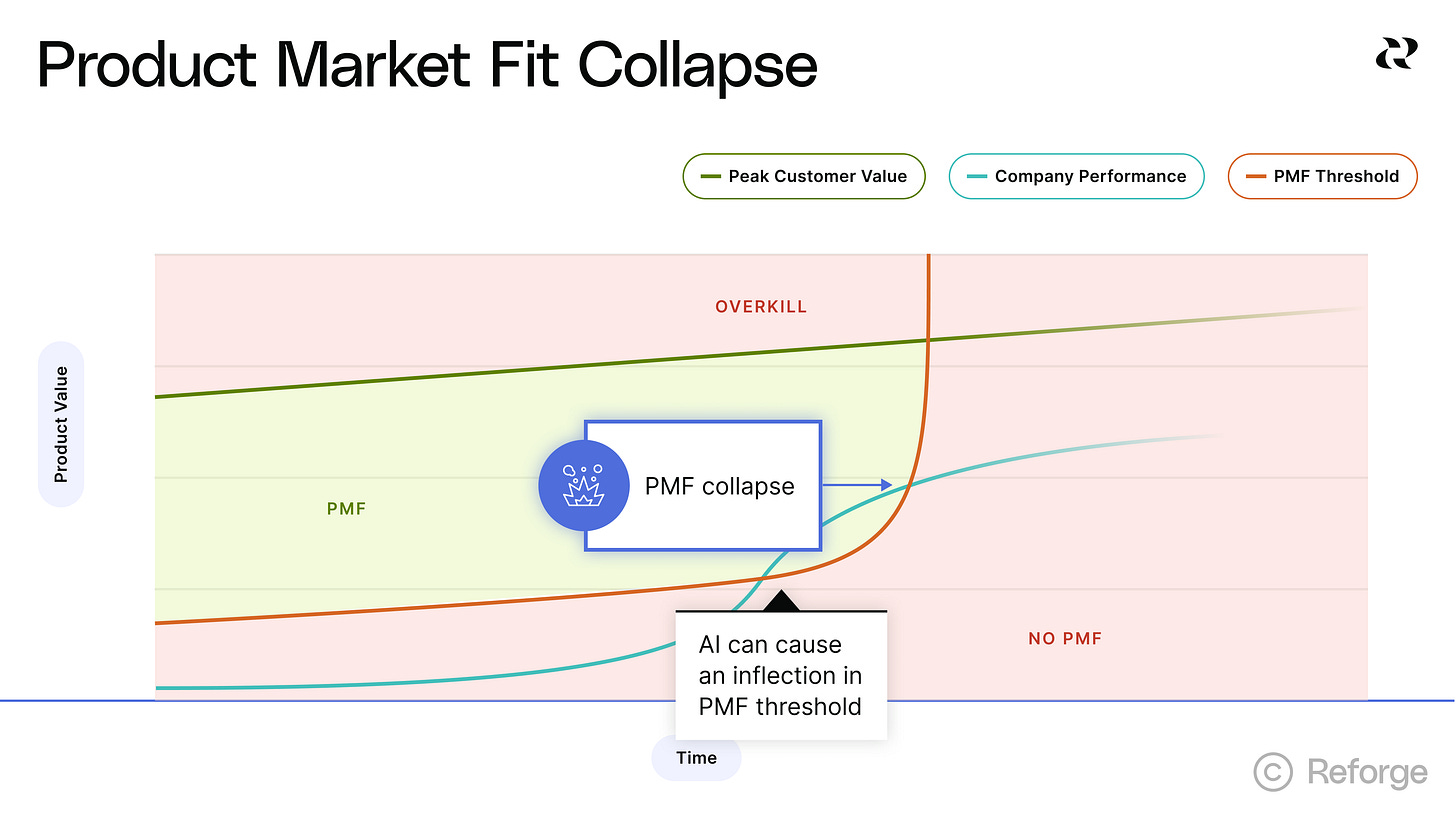

As a result, we don’t see the Product Market Fit threshold accelerate, we can see it inflect. And when that happens, a company can lose Product Market Fit overnight.

Chegg illustrates this well. In January 2024, it was valued at $1.2 billion. By October 2024 (9 months later), it was valued at $150 million. A 90% decline in nine months, losing a half a million subscribers in that time. It went from essentially break even in 2023 to losing $600 million in Q3 2024 alone.

How Chegg’s product market fit collapsed

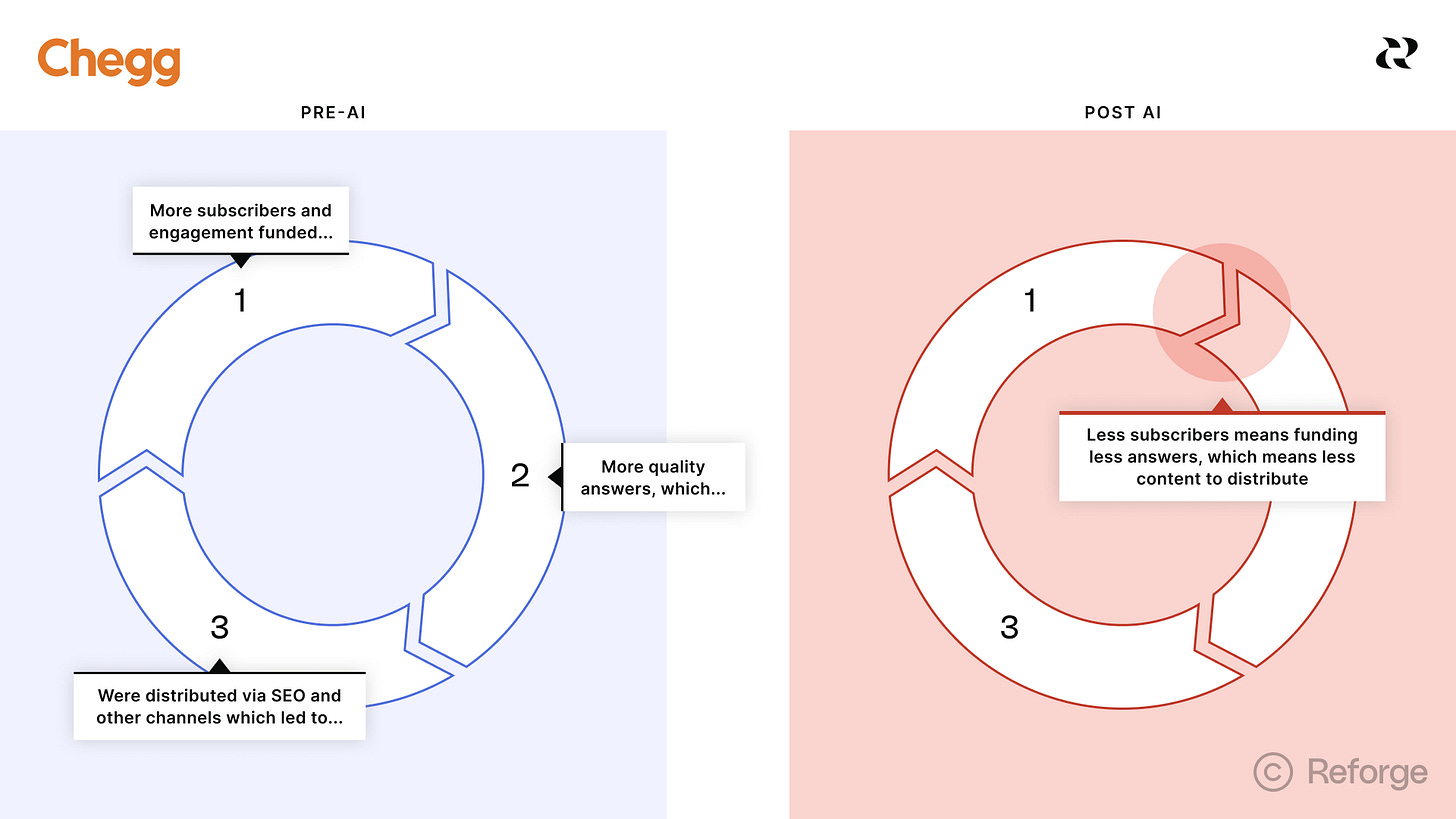

Chegg’s primary subscription offered homework help to students. The main value prop was high-quality answers written by curated humans. If we look at it through the lens of its growth model, its core growth loop is a company-generated, company-distributed content loop. More quality answers were then distributed via SEO and other channels, which led to more subscribers and engagement, which led to funding more quality answers.

But when OpenAI launched ChatGPT, students could just enter their homework and get an immediate personalized answer. The answer wasn’t always right, but the fact that it was instant and free created both a 10x value prop and immediate distribution.

It broke the growth loop. As subscribers started to churn, Chegg could fund less company-generated content, which leads to less new subscribers and engagement, which leads to less money, which leads to funding less company-generated content.

It’s not uncommon for companies to have to innovate their way out of changing dynamics, but it’s happening too fast right now. Chegg has responded on a pretty typical timeline. It launched its first AI features 26 months after ChatGPT launched. In the past, that may have been a fast enough response, but not in the AI era.

How Product Channel Fit changes

The second of the four fits is Product Channel Fit. All successful products are built off the back of another channel. TikTok leveraged Facebook Ads, Booking.com leveraged Google Ads, and HubSpot leveraged Google SEO. Product Channel Fit states that products are built to mold to channels. Channels do not adapt to your product. That is because you do not have control of the channels where your audience lives. You play by their rules.

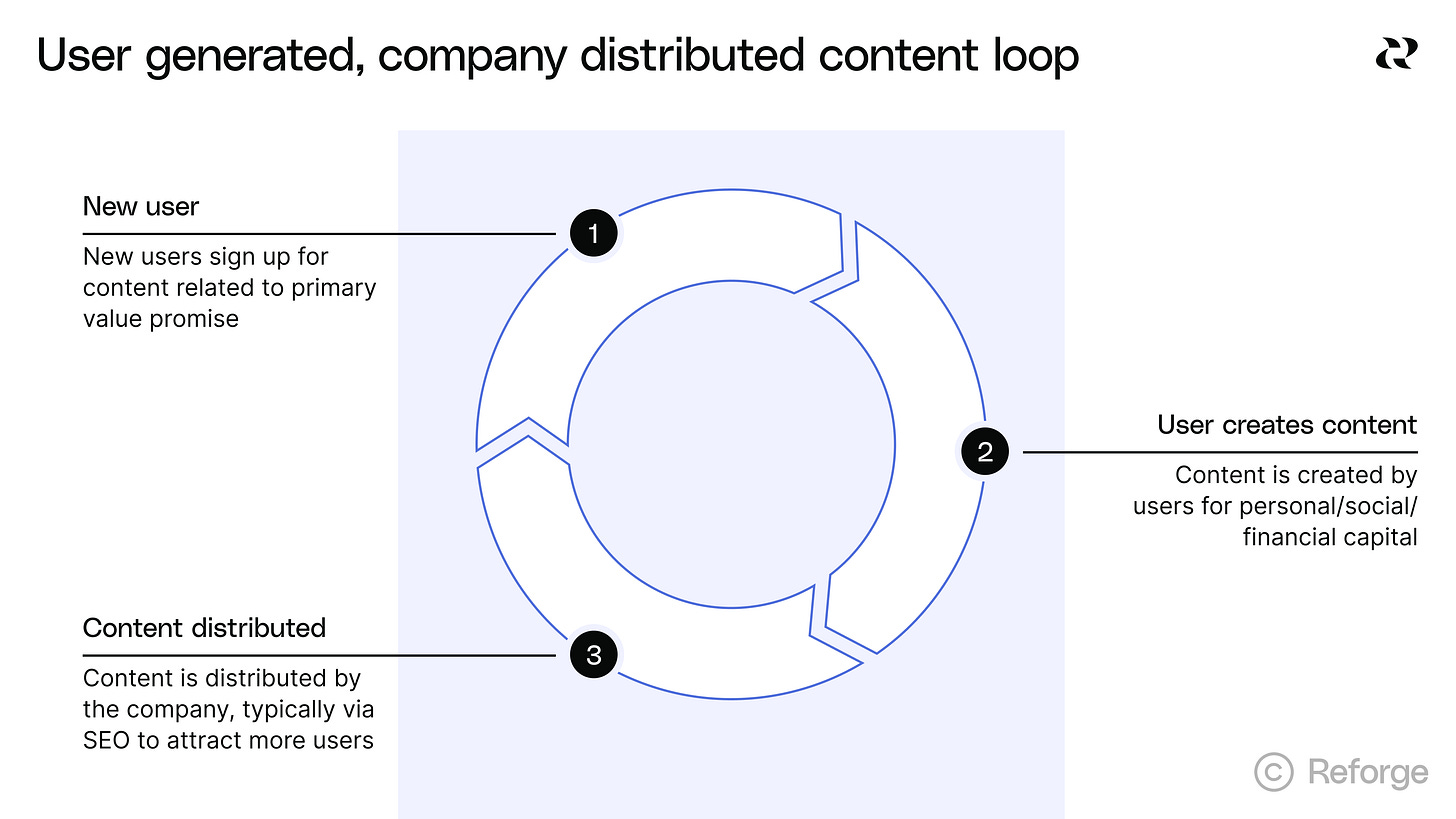

There is an entire ecosystem of $1 billion+ companies built on the back of long-tail SEO. Pinterest, TripAdvisor, Quora, G2 and Quora just to name a few. At the center of their growth model is a core growth loop: User Generated, Company Distributed Content Loop:

Step 1: A new user signs up (or existing user returns)

Step 2: They create a piece of content on the platform (a review, a pin, etc.)

Step 3: Company optimizes pages of that content to be indexed by Google.

Step 4: A new or existing user finds that piece of content in a search (repeat step 1)

This isn’t just B2C companies either. B2B companies like G2 and HubSpot have built the majority of their growth engine around similar loops. All these companies have spent 10+ years tuning and optimizing their products to tap into SEO.

What happens if the channel loses product market fit?

Here’s the risk companies should be aware of today: Imagine a scenario where a major platform like Google suddenly loses its Product Market fit. The ripple effects would be dramatic and far-reaching. Companies like TripAdvisor and Pinterest, which rely heavily on search traffic, would face immediate existential challenges. This disruption would then cascade down to thousands of smaller businesses that depend on these intermediary platforms.

At the time of this writing, we’ve seen some declines in some of these channels, Google especially. We have not seen the instant collapse. However, we’ve already seen that AI can have a rapid, nearly instant impact when it “clicks.” So, companies need to pay close attention to their distribution channels and prepare for disruptions.

What if a new channel emerges?

There’s a second scenario that companies often miss. Your existing channel doesn’t need to tank for you to face disruption. What if a major new channel emerges and your users start forming entirely new habits there?

When Facebook’s platform launched in 2007, people didn’t stop visiting web game portals like Webclip and Yahoo Games. But there was suddenly a new place where people were spending significant time and building habits. Web game companies tried to copy and paste their games into Facebook’s environment and failed completely. The games weren’t built for how people behaved in that social context (playing with friends rather than solo).

The same pattern repeated with mobile. Social game companies attempted to port their web experiences directly to mobile devices. It didn’t work because mobile usage patterns were fundamentally different.

The ChatGPT disruption is happening right now

As I described in The Next Great Distribution Shift, we’re seeing this exact pattern unfold today with AI. For many product categories, people are starting their research and discovery process on ChatGPT instead of traditional search engines or category-specific sites. This represents a fundamental shift in user behavior and starting points.

The implications vary dramatically by industry. Companies selling high-consideration purchases like travel or cars face immediate pressure. Users are conducting extensive research on ChatGPT before ever visiting traditional booking sites or dealer websites. These companies must figure out how to extend their products into AI channels or risk losing customers to competitors who do.

You’re vulnerable even when your channels are stable

You can be disrupted even if your existing channels continue performing well. If your audience shifts significant time and attention to new channels, you need to figure that channel out ASAP. Otherwise, you leave yourself open to being disrupted by a new player that figures out that channel first.

How Channel Model Fit changes

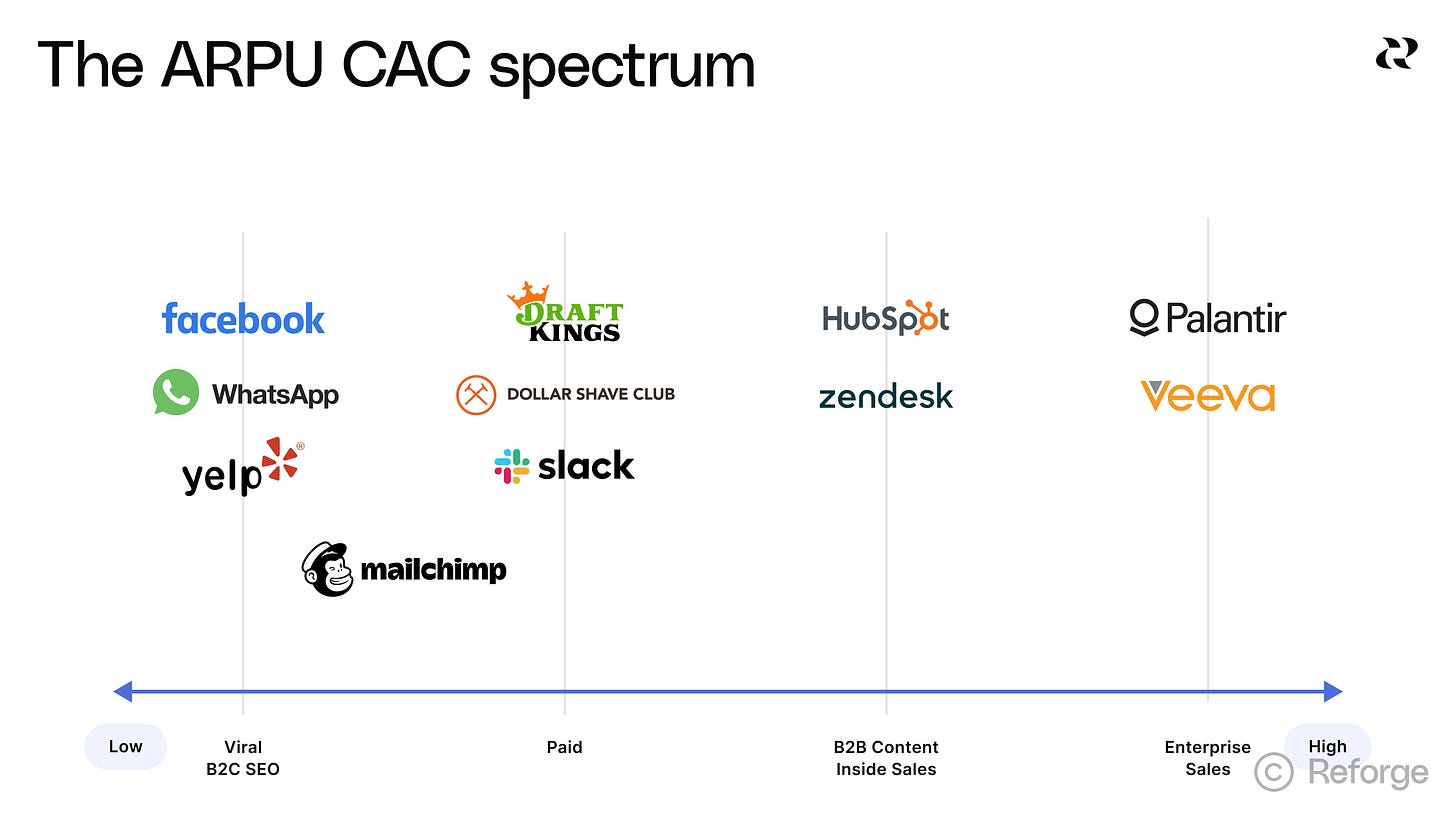

The third fit is Channel Model Fit. In Channel Model Fit, the channels that are viable for you to use are determined by your monetization model (how you charge, when you charge, what you charge for, how much you charge).

We’ve historically explained this through the ARPU ↔ CAC Spectrum. Every business lives on the ARPU ↔ CAC Spectrum. On one side, you have businesses with low ARPU and, as a result, have to use low CAC channels to drive customers. On the other side, you have businesses that have high ARPU and are therefore able to use high CAC channels.

There are a couple of ways that Channel Model Fit could collapse:

Cost increases break GTM: One of the new problems that AI has introduced in monetization is meaningful costs with every use of the product. For example, freemium products will have difficulty introducing meaningful AI features as part of the free tier without drastically increasing the costs to support those free users. Traditional SaaS gross margins were typically above 70%. The Information reported that Lovable’s gross margin is 35% but it doesn’t include the cost of serving free users as part of that, which would drive it much lower. Depending on the product, this can break Channel Model Fit.

Channel collapses could trigger monetization changes: Many products heavily rely on SEO traffic to drive inexpensive traffic to their low-priced or free products. But as the amount of organic traffic decreases, it may force companies to shift to other more expensive channels like paid advertising. They will then need to change their monetization model to align with the increased cost of those channels. This could be especially challenging when paired with increased costs to serve.

Shifts in user adoption behavior: AI-powered innovations can create instant shifts in user behavior. For instance, if an AI plugin or chatbot reduces the friction of discovering and trying new solutions, potential customers might expect a near-zero friction trial. But higher-priced or more complex products still demand lengthy demos or a big sign-up fee. Almost overnight, your tried-and-true channels (e.g., lengthy content marketing funnels) might become far less effective. AI can fundamentally change where and how users make purchase decisions, invalidating established channel strategies.

Channel Model Fit hinges on having pricing and ARPU that align with the channels you use to acquire customers. If AI instantly upends that balance, you could end up:

Stranded in the “Danger Zone.” If your ARPU is too low to afford human-powered sales, but too high/complex to succeed on low-cost viral or paid channels, you end up stuck.

Massive churn or halted growth. If a competitor’s AI-driven product is cheaper or drastically more effective, your customers may churn en masse. Meanwhile, your inability to adapt channels quickly can stall new customer acquisition.

Ballooning CAC and negative unit economics. In an effort to respond, you might try layering on AI consultancies or bigger marketing campaigns. But if you can’t recoup that expense within a year, you burn through capital fast. This negative cycle jeopardizes your company’s viability.

Forced pricing and product overhauls. In a scramble to regain fit, companies may attempt to re-price overnight or re-bundle their offerings. But these rushed changes often don’t seamlessly align with the channels you’ve built—leading to confusion in the market, internal misalignment, or suboptimal “patchwork” channel strategies.

Increased competitive pressure to move up or down market. If the AI wave commoditizes your existing segment, you might have to move up-market and serve enterprise customers, but that requires building out (and affording) a high-touch sales team. Or, you might need to go down-market—lower ARPU and rely on low-friction, product-led channels. Either direction is a fundamental pivot that can be risky, costly, and time-consuming.

The companies that survive this transition will be those that monitor their Channel Model Fit closely and can pivot quickly when the fundamentals shift. The key is building flexibility into your monetization strategy before you’re forced to change it under pressure.

How Model Market Fit changes

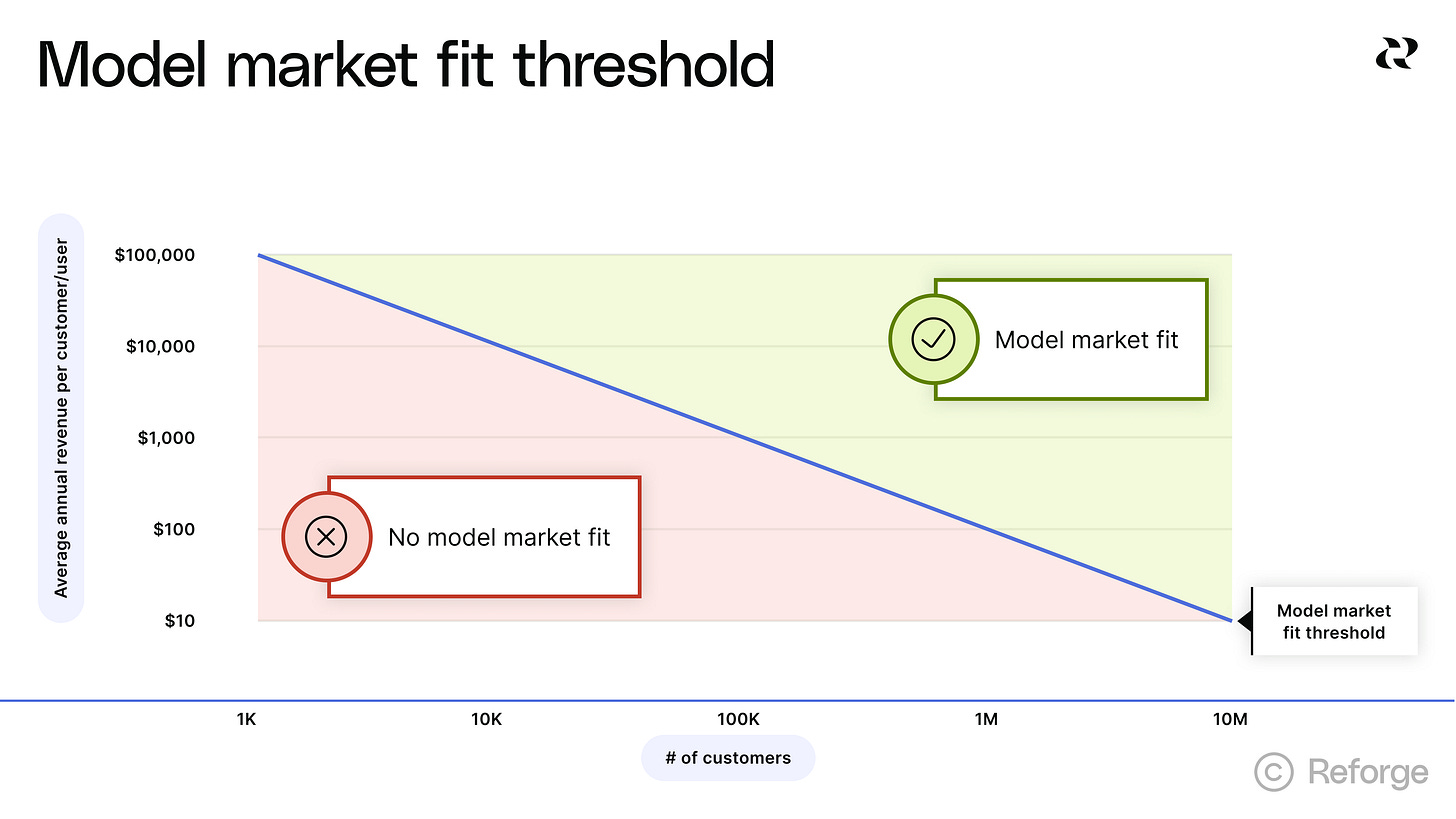

Model Market Fit is the concept that your market (and number of customers within your market) influence your model. Years ago, Christoph Janz from Point Nine Capital wrote a great post called The Five Ways To Build A $100 Million Business. It describes the number of customers you need at different price points to grow to $100 million.

Most companies end up falling into one of five areas that Christoph named:

Elephants: Products that get 1,000 customers paying $100k+ a year. These are typically products built for enterprise customers like ServiceNow.

Moose: Products that get 10,000 customers paying you $10k+ per year. These are typically products built for the mid-market like HubSpot.

Rabbits: Products that get 100,000 customers paying $1k per year. These are typically products targeting small businesses like SurveyMonkey, Mailchimp, or Gusto. Products targeting consumers at high value moments also live here. For example, companies in real estate, insurance, etc.

Mice: Products that get one million customers paying $100 per year. These are typically products that target prosumers like Dropbox, or companies that are subscription e-commerce like Ipsy or Dollar Shave Club.

Flies: Products that get 10 million customers generating $10 per year typically via ads. Facebook, Snapchat, Buzzfeed, etc. all live here.

This can be visualized in this chart:

The diagonal line represents $100m in revenue. You can pinpoint your own business on this chart by finding your ARPU on the Y-axis and the number of customers you have on the X-axis. If you’re above the line, you have Model Market Fit. If you’re below it, you don’t.

AI breaks the math

AI is expanding some markets and shrinking others. This changes the math. Customer support teams have drastically shrunk because AI has replaced a lot of the work. Vendors selling seats suddenly have way fewer people to sell to, so the math of customers times ARPU breaks down.

But this creates an opportunity for a tool like Intercom’s Fin, an AI support bot, that monetizes based on resolved tickets. At 99 cents each, it needs to resolve just over 100m tickets per year to find Model Market Fit. (As a side note, as of August 2025, Fin resolves more than 1 million tickets per week.) If Fin sold seats to customer support teams, it’d likely collapse but AI has enabled a new solution that didn’t previously exist.

Are bigger markets always better?

Some markets are absolutely exploding. Companies like Cursor and Windsurf are tapping into a much larger TAM. AI writes the code, meaning a lot more people can develop products. Lovable, Bolt, Replit and v0 take this to another level and are tapping into a new market altogether. Building apps without any code at all creates an almost infinite TAM.

Replit grew revenue 50x in the last 12 months and has 40 million users and 175,000 paying customers, according to Sacra. It found escape velocity with a product-led growth motion and massive interest in vibe coding. Since then, it’s turned its attention towards team and enterprise, looking to gain traction as a B2B utility for product and design teams.

This is a case where a big market is the spark, but only 0.44% of Replit users actually want to pay. So while freemium plans can drive tons of free usage, (1) that usage can be expensive and (2) it is not necessarily a clear indicator that users will be compelled to pay for more.

Carta reports that 1,700+ startups shut down in 2023 and 2024, a significant uptick over previous years. Good ideas, great products and even plenty of interest from users ≠ long-term success.

The buyer persona shift

AI creates new buyer personas with different authority, timelines, and success metrics. The traditional IT buyer focused on features and integrations. The AI buyer often comes from operations, evaluating against headcount savings and process automation. Their approval processes, budget sources, and implementation timelines operate on completely different cycles than traditional software purchases.

Many of us have gotten so used to jumping around from one free/freemium AI tool to another that it’s hard to imagine a procurement team choosing a single tool to roll out to an entire company. But that’s already happening and it’ll shift buying power from early adopter types to CTOs.

3 ways AI causes Model Market Fit collapse

AI has the power to unravel one or more variables in the Model Market Fit equation in three ways:

Dramatic reduction in ARPU: AI-driven tools often automate and commoditize what was once a complex or high-value service. For instance, if you’ve been charging $1,000/year for a product (like specialized analytics or content generation), a new AI-based competitor might drop the average price to $100/year or even free (supported by ads or data-collection).

TAM contraction or fragmentation: Sometimes AI doesn’t just reduce prices, it also fundamentally changes who is a viable customer. Suppose your product’s main market was companies needing data entry. If AI automates large chunks of data processing, then suddenly the market itself (i.e., the set of customers who need your old solution) shrinks drastically.

Serviceable addressable market (SAM) contraction: Even if the market is still there and your ARPU remains the same, AI can create new winners with network effects or brand-new approaches, making it harder for incumbents to keep (let alone grow) market share.

Rabbits are becoming Moose in some cases, while Mice turn into Flies in others. The change to become a $100 million business still exists, but the path may look different.

Risk on one side, opportunity on the other

This is all happening so fast. I hope this post triggers at least some urgency on your part. For all the risk out there, windows of massive opportunity are also opening. The move right now is to analyze Product, Market, Channel and Model for your business, then look closely at how each of the Four Fits is working, or not.

The Four Fits are a significant part of our new AI Growth course. It’s a massive overhaul of our 10-year-old Growth course, which has been taken by tens of thousands of product builders and has been a staple of our business for a decade now. You can enroll here.

I’m always wary of 'Tugboat' companies, those with a great product but a broken distribution or model fit. This framework is a good filter for identifying 'Smooth Sailers.'

Super helpful refresh. What stands out to me is how AI speeds up the collapse of PMF. It feels like the window to adapt is way shorter now. Curious how you see teams handling that?